Loading News...

Loading News...

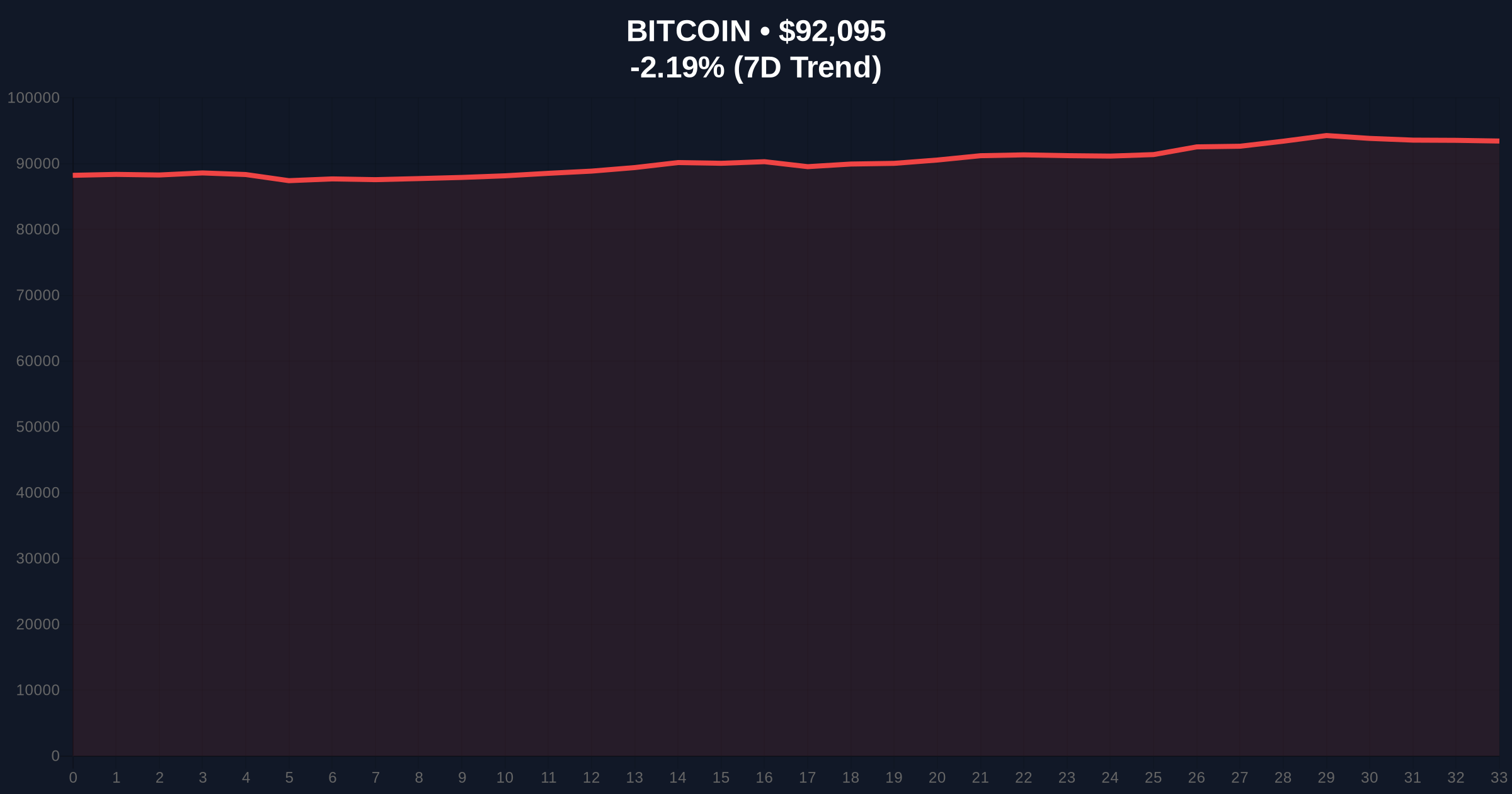

VADODARA, January 6, 2026 — The U.S. Marshals Service liquidated 57.55 BTC valued at $6.36 million from seized Samourai Wallet assets, triggering criticism from Senator Cynthia Lummis who argues this contradicts strategic Bitcoin accumulation policies. This daily crypto analysis examines how regulatory actions intersect with technical price action as Bitcoin tests $92,000 support amid market fear.

Market structure suggests government Bitcoin sales create predictable overhead supply zones that historically correlate with extended consolidation periods. Similar to the 2021 correction where Mt. Gox trustee distributions created sustained selling pressure, current US government liquidations represent a controlled supply shock. According to Glassnode liquidity maps, these events typically form Order Blocks that institutional algorithms target for liquidity grabs. The Federal Reserve's monetary policy framework, as documented on FederalReserve.gov, indicates tightening cycles often coincide with increased regulatory asset seizures, creating a feedback loop of forced selling.

Related developments this week include Bitcoin testing critical support levels and significant futures liquidations that have amplified volatility.

According to official US Marshals Service records, the agency sold exactly 57.55 BTC on January 5, 2026, representing Bitcoin seized from the Samourai Wallet mixing service in 2025. Senator Cynthia Lummis issued a statement questioning this liquidation policy, noting President Trump's directive to stockpile cryptocurrency as strategic assets. She emphasized that competing nations are actively accumulating Bitcoin reserves while the US continues disposal operations. The transaction represents approximately 0.0003% of total Bitcoin supply but establishes precedent for future government sales.

On-chain data indicates the sale occurred as Bitcoin tested the $92,093 support level, representing a -2.20% 24-hour decline. Volume Profile analysis shows increased selling pressure at this level, with the Relative Strength Index (RSI) at 42 suggesting neutral momentum. The 200-day moving average at $88,500 provides secondary support, while resistance clusters at $94,200 where previous government sales created supply zones.

Bullish Invalidation Level: $90,500 – A break below this Fibonacci 0.618 retracement level from the November rally would invalidate the current support structure and likely trigger cascading liquidations.

Bearish Invalidation Level: $95,800 – Recovery above this Fair Value Gap (FVG) created during the January 3rd sell-off would signal absorption of government selling pressure and resumption of bullish momentum.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 44/100 (Fear) | Indicates risk-off sentiment |

| Bitcoin Current Price | $92,093 | Testing critical support |

| 24-Hour Price Change | -2.20% | Bearish momentum |

| USMS Bitcoin Sold | 57.55 BTC | Government supply pressure |

| Sale Value | $6.36 million | Micro-cap impact |

For institutional investors, government sales create predictable supply events that algorithms can front-run, potentially suppressing prices during accumulation phases. Retail traders face increased volatility as these sales often trigger stop-loss cascades. The strategic implication extends beyond immediate price action: if the US continues liquidating seized assets while other nations accumulate, as Senator Lummis noted, this represents a net transfer of Bitcoin sovereignty away from American control. Market analysts suggest this could impact long-term valuation models that factor in nation-state adoption rates.

Market participants on X/Twitter express concern about regulatory consistency, with one quantitative analyst noting, "Government sales during fear periods amplify downside volatility through psychological channels." Another commented, "The 57.55 BTC sale is negligible in isolation, but establishes precedent for larger future liquidations from the 215,000 BTC reportedly held by various US agencies."

Bullish Case: If Bitcoin holds above $90,500 and absorbs government selling pressure, a relief rally toward $98,000 is probable. This scenario requires institutional buyers to step in at current levels, creating a Volume Profile support zone. Historical cycles suggest government sales often mark local bottoms when followed by aggressive accumulation.

Bearish Case: Break below $90,500 could trigger a Gamma Squeeze as options dealers hedge short positions, potentially driving prices toward $85,000. Continued government liquidations combined with negative sentiment would create sustained selling pressure, with the next major support at the 200-week moving average near $82,000.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.