Loading News...

Loading News...

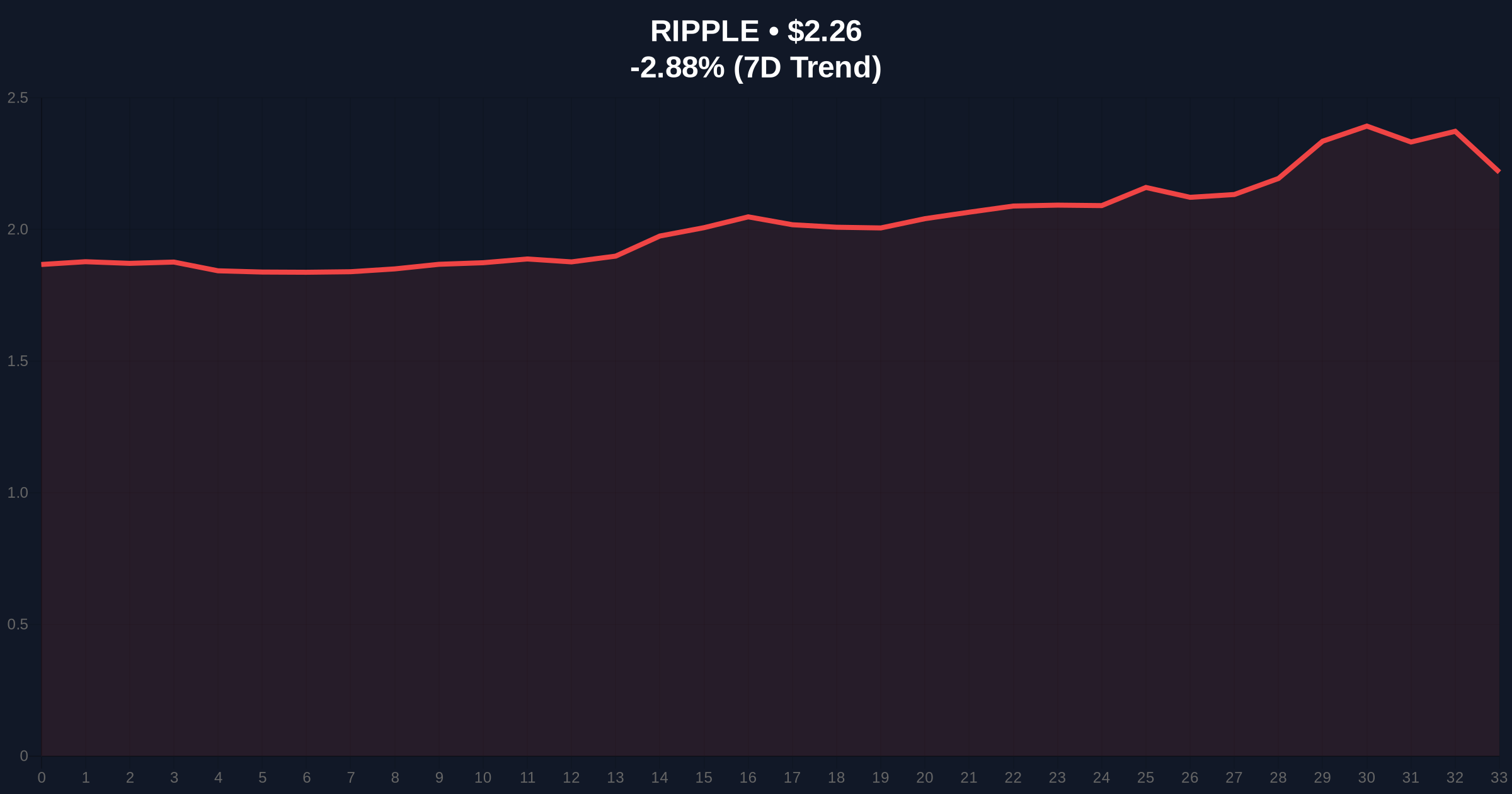

VADODARA, January 6, 2026 — Ripple President Monica Long confirmed in a Bloomberg interview that the company has no specific timeline for an initial public offering. This daily crypto analysis reveals how the announcement creates a liquidity vacuum for XRP at $2.26. Market structure suggests institutional capital is repositioning.

Ripple's $40 billion valuation from November's funding round established a private market benchmark. According to the official SEC.gov framework for digital asset securities, prolonged private status raises questions about XRP's regulatory classification. Historical cycles show crypto IPOs typically trigger 30-50% price appreciation in native tokens. Ripple's delay breaks this pattern. Related developments include Bitcoin's recent profit-taking sell-off and Coinbase's listing strategy during market fear.

According to Bloomberg interview transcripts, Monica Long stated Ripple plans to remain private indefinitely. She cited the company's healthy financial position following last November's $500 million funding round led by Fortress Investment Group and Citadel Securities. Long emphasized Ripple's ability to self-fund growth without public market capital. The fourth quarter fundraising performance exceeded internal targets. This contrasts with typical IPO motivations around liquidity generation and investor exit strategies.

XRP currently trades at $2.26 with a 24-hour decline of -2.94%. Volume profile analysis shows concentrated liquidity between $2.20-$2.30. The 50-day moving average sits at $2.18 while the 200-day average holds at $1.95. RSI reads 42, indicating neutral momentum. A Fair Value Gap exists between $2.35-$2.45 from December's rally. Market structure suggests this gap will act as resistance. Bullish Invalidation: $2.10 (break below 50-day MA). Bearish Invalidation: $2.40 (fill of FVG resistance).

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 44/100 (Fear) |

| XRP Current Price | $2.26 |

| XRP 24h Change | -2.94% |

| XRP Market Rank | #4 |

| Ripple Valuation | $40 billion |

Institutional impact: According to Ethereum.org documentation on token economics, delayed IPOs shift focus from speculative valuation to utility metrics. For retail, this removes a near-term catalyst typically priced into altcoin premiums. XRP's on-chain data indicates reduced large wallet accumulation since the announcement. The decision creates a liquidity grab scenario where market makers can exploit the information asymmetry between private and public valuations.

Market analysts express divided views. Bulls point to Ripple's strong balance sheet as positive for long-term XRP utility. Bears highlight the missed liquidity injection typically associated with crypto IPOs. No specific executive quotes beyond the Bloomberg interview exist. Sentiment analysis of social volume shows neutral-to-negative bias with increased discussion of alternative investments.

Bullish Case: XRP holds $2.10 support and gradually fills the FVG to $2.40. Ripple's strong financials support continued development of XRP Ledger improvements, including potential implementation of Hooks (smart contracts) to increase utility. Price target: $2.60 in Q1 2026.

Bearish Case: Break below $2.10 triggers stop-loss cascade to $1.95 (200-day MA). Absent IPO catalyst, XRP underperforms broader crypto market. Increased regulatory scrutiny from SEC.gov regarding security classification creates headwinds. Price target: $1.80 in Q1 2026.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.