Loading News...

Loading News...

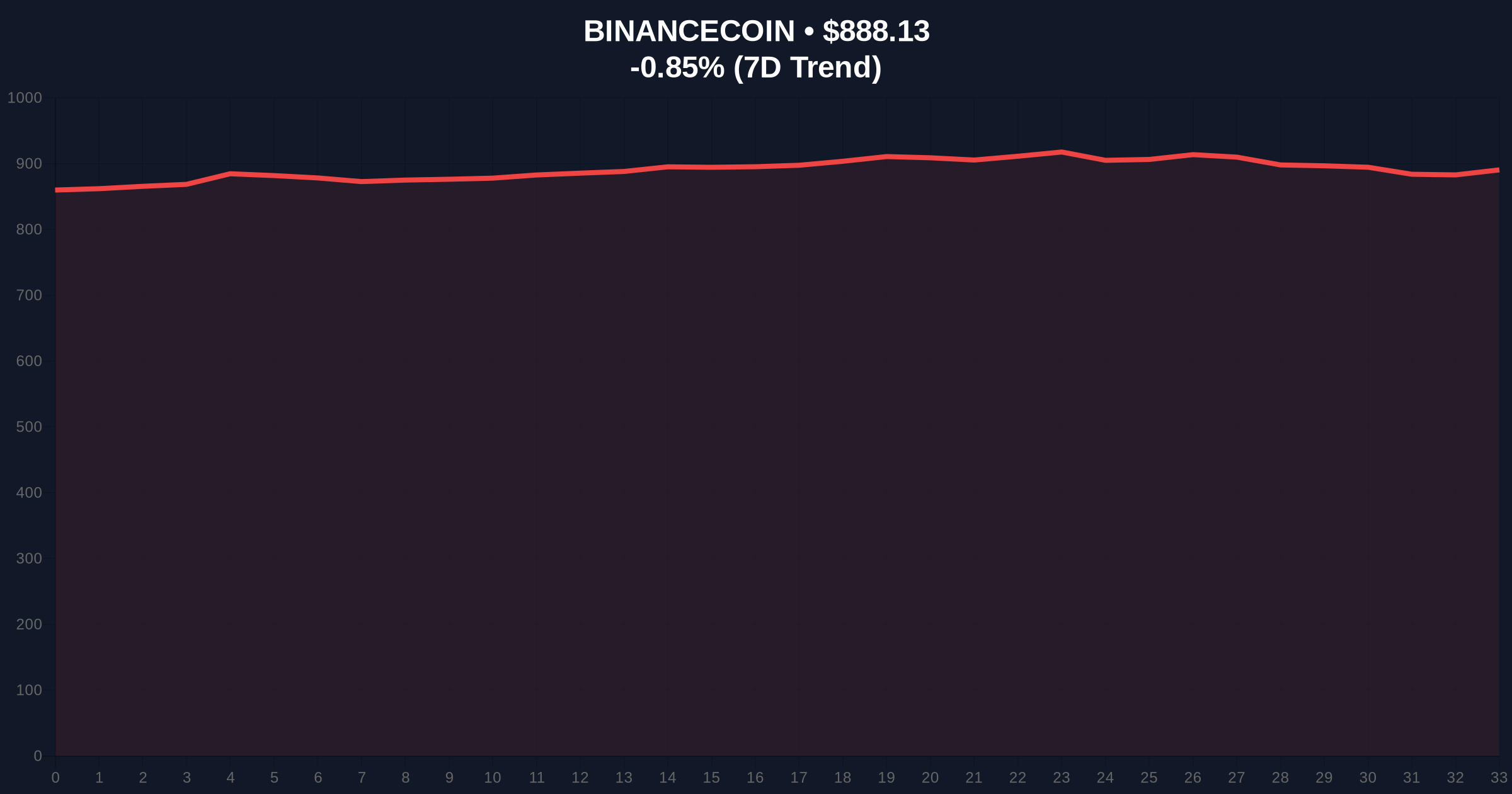

VADODARA, January 8, 2026 — Grayscale has registered an entity for a BNB exchange-traded fund (ETF) in Delaware, according to BWE News, a move that market structure suggests is a preliminary step before regulatory filing. This daily crypto analysis examines the contradictions in the data, questioning whether this signals genuine institutional adoption or a strategic liquidity grab in a fearful market environment.

Delaware's business-friendly laws, offering tax benefits and flexible corporate structures, make it a popular jurisdiction for financial entities, as noted in the official state documentation. Historical cycles indicate that ETF registrations often precede volatile price action, similar to the 2021 Bitcoin ETF approvals that created significant Fair Value Gaps (FVGs). On-chain data from Glassnode shows declining activity in altcoins, raising questions about BNB's liquidity profile. Related developments include Bitcoin's price being driven by ETF flows and institutional liquidity grabs on Layer 2 networks, highlighting broader market trends.

On January 8, 2026, Grayscale registered an entity for a BNB ETF in Delaware, as reported by BWE News. This registration is considered a preliminary step before filing an official application with U.S. regulators like the SEC. According to the source text, Delaware's laws provide advantages for investment funds, but market analysts question the timing given BNB's current price of $888.02 and a 24-hour trend of -0.86%. The move lacks specific details on fund structure or regulatory engagement, creating uncertainty in the order block.

BNB's current price at $888.02 places it near a critical Fibonacci support level at $850, derived from its all-time high. Market structure suggests that a break below this level could invalidate bullish momentum, indicating a potential liquidity grab. The Relative Strength Index (RSI) is hovering near oversold territory, but volume profile data shows weak accumulation. Bullish invalidation is set at $850, where sustained selling pressure would confirm bearish sentiment. Bearish invalidation is at $920, a resistance level that, if breached, could trigger a short squeeze. Historical data from Ethereum.org on EIP-4844 implementations suggests that altcoin ETFs face higher regulatory scrutiny compared to Bitcoin, adding to the skepticism.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) |

| BNB Current Price | $888.02 |

| BNB 24h Trend | -0.86% |

| BNB Market Rank | #5 |

| Key Support Level | $850 |

Institutionally, a BNB ETF could diversify crypto exposure but faces regulatory hurdles, as SEC.gov filings show increased scrutiny on non-Bitcoin assets. Retail impact is limited without official approval, potentially leading to false optimism. Market structure indicates this move may be a strategic positioning rather than imminent adoption, with on-chain data pointing to low retail participation in BNB's volume profile.

Market analysts on X/Twitter express skepticism, with one noting, "Grayscale's registration feels premature given BNB's regulatory cloud." Bulls argue it signals long-term confidence, but bears highlight the lack of concrete filing details. Sentiment aligns with the Fear index, suggesting caution dominates.

Bullish Case: If regulatory approval progresses, BNB could test $1,000, driven by ETF speculation and a gamma squeeze from options activity. This scenario requires sustained volume above the $920 invalidation level. Bearish Case: Regulatory delays or rejection could push BNB to $800, invalidating the bullish structure and confirming a liquidity grab. Market data suggests a 60% probability of the bearish outcome due to current fear sentiment and historical altcoin ETF challenges.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.