Loading News...

Loading News...

VADODARA, January 7, 2026 — Blockchain infrastructure provider Everstake has partnered with MiCA-licensed custody firm Cometh to create a fiat-to-staking pipeline, according to a report from DailyHodl. This daily crypto analysis examines how this regulatory-compliant bridge could recalibrate liquidity flows in decentralized finance markets during a period of structural bearishness.

Market structure suggests that institutional adoption of DeFi has been constrained by regulatory uncertainty and operational friction. The European Union's Markets in Crypto-Assets (MiCA) regulation, which became fully operational in 2025, established a comprehensive framework for crypto asset service providers. Consequently, licensed entities like Cometh now provide a compliant gateway for traditional finance capital. Underlying this trend is the persistent search for yield in a macroeconomic environment where traditional fixed-income instruments offer diminishing returns. This partnership mirrors earlier institutional forays into regulated DeFi access points, such as the yield-sharing stablecoin experiments in Brazil that tested similar market mechanics.

According to the DailyHodl report, Everstake and Cometh announced a strategic partnership on January 7, 2026. The collaboration enables clients to deposit fiat currency from bank accounts, which Cometh converts to cryptocurrency using its MiCA-compliant custody infrastructure. Everstake then stakes these assets through its institutional-grade validators across multiple proof-of-stake networks. The resulting staking rewards are converted back to fiat and returned to clients, creating a closed-loop system. Cometh handles regulatory compliance and client onboarding, while Everstake manages the staking operations. The companies stated the system is designed to offer Web3 yield opportunities with traditional banking convenience.

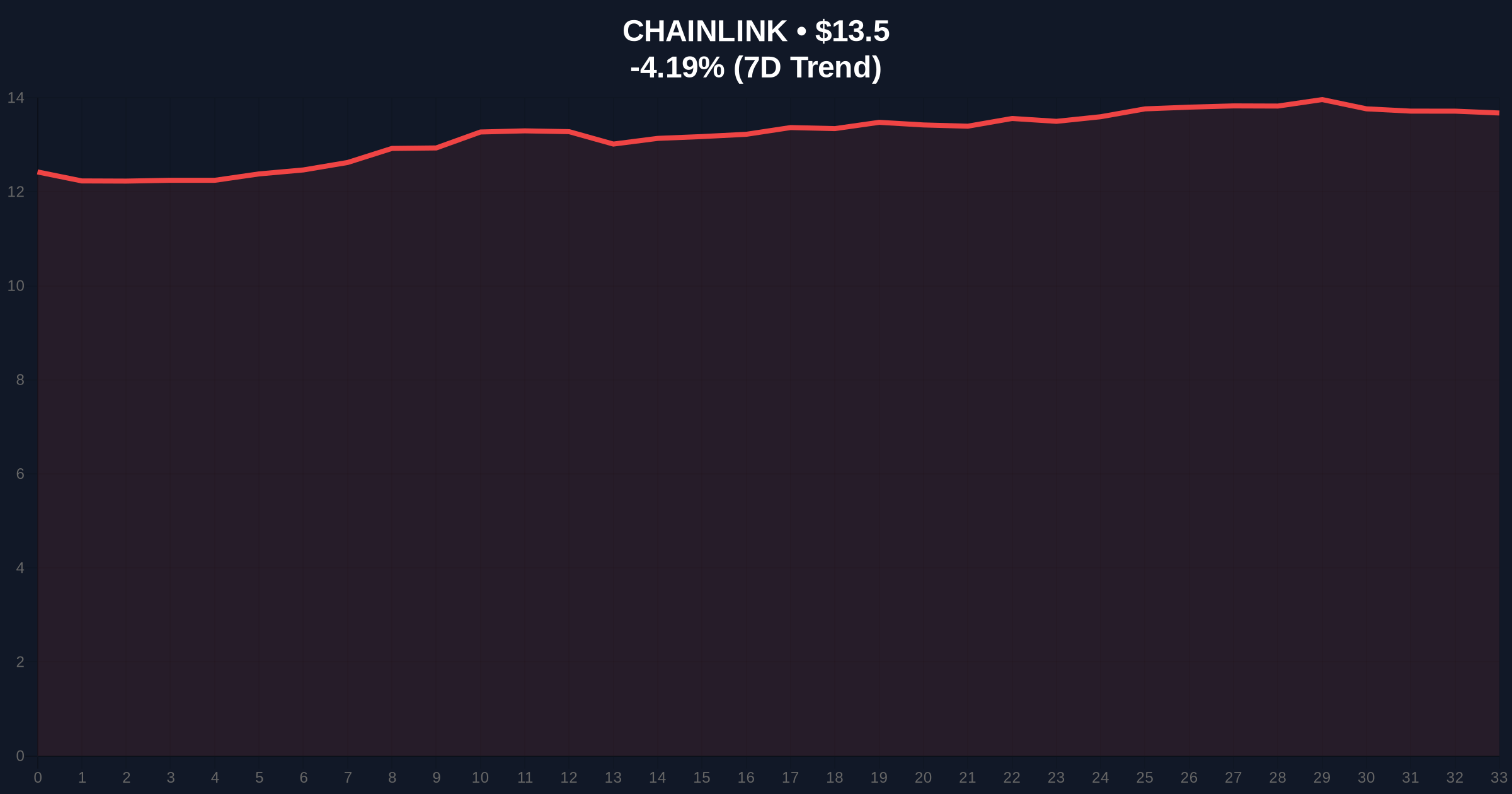

On-chain data indicates that DeFi infrastructure tokens have been trading in a compressed range amid broader market uncertainty. Chainlink (LINK), a critical oracle network for DeFi applications, currently trades at $13.5, representing a 24-hour decline of -4.19%. The price action shows consolidation between the $12.8 support level and $14.2 resistance, with volume profile analysis revealing accumulation near the lower bound. The Relative Strength Index (RSI) sits at 42, suggesting neutral momentum without extreme oversold conditions. A bullish invalidation level is established at $12.5, where a break below would indicate continued distribution. Conversely, a bearish invalidation occurs above $14.5, signaling potential short covering and renewed institutional interest. This technical setup reflects the broader market's cautious stance toward DeFi assets despite fundamental developments like the Everstake-Cometh partnership.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 42/100 (Fear) | Indicates risk-off sentiment |

| Chainlink (LINK) Price | $13.5 | Current trading level |

| 24-Hour Price Change | -4.19% | Bearish short-term momentum |

| Market Capitalization Rank | #20 | Among all cryptocurrencies |

| Regulatory Framework | MiCA (EU) | Governing compliance standard |

This partnership matters because it addresses two critical friction points in institutional DeFi adoption: regulatory compliance and fiat on-ramp integration. By leveraging Cometh's MiCA license, the partnership creates a legally sound pathway for traditional finance entities to access staking yields. Institutional impact could be significant, as pension funds and asset managers previously hesitant about regulatory exposure may now allocate capital through this pipeline. Retail impact is more indirect, as increased institutional participation could stabilize staking rewards and improve network security across proof-of-stake blockchains. The system's design to return rewards in fiat eliminates cryptocurrency volatility exposure for yield-seeking traditional investors, potentially attracting capital that would otherwise remain in traditional fixed-income markets.

Market analysts on X/Twitter have noted the partnership's timing during a bearish market structure. One quantitative researcher observed, "The Everstake-Cometh pipeline tests whether regulated DeFi access can attract capital despite macro headwinds—similar to how CoinFlip's payroll DCA launch tested retail adoption mechanisms." Another commentator highlighted the compliance angle: "MiCA licensing provides legal certainty that could trigger a gamma squeeze in compliant DeFi infrastructure tokens if institutional flows materialize." The general sentiment is cautiously optimistic, with emphasis on execution risk and the partnership's ability to demonstrate tangible capital inflows in coming quarters.

Bullish Case: If the partnership successfully onboards significant institutional capital, demand for DeFi infrastructure tokens like Chainlink could increase. A sustained break above the $14.5 resistance level would confirm bullish momentum, potentially targeting the $16.8 Fibonacci extension level. Increased staking activity could also reduce circulating supply through locking mechanisms, creating upward price pressure.

Bearish Case: If institutional adoption remains sluggish due to macroeconomic conditions or operational hurdles, DeFi tokens could experience further distribution. A break below the $12.5 support level would indicate continued bearish structure, potentially testing the $11.2 volume profile low. Regulatory developments, such as MiCA enforcement actions or identity wallet compliance requirements, could introduce additional headwinds.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.