Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Former Qualia Research head Winslow Strong moved $32.6 million in CBBTC and ETH from Aave to Coinbase amid extreme fear market conditions

- Transaction timing coincides with Ethereum testing critical Fibonacci support at $2,850 and global crypto sentiment at 20/100

- Market structure suggests potential liquidity grab below $2,900 ETH, creating a Fair Value Gap (FVG) that needs filling

- Bullish invalidation at $2,800 ETH, bearish invalidation at $3,050 based on volume profile analysis

VADODARA, December 26, 2025 — In a move that contradicts prevailing market narratives, an address associated with Winslow Strong, former head of crypto research firm Qualia Research, withdrew 307 CBBTC ($27.03 million) and 1,900 ETH ($5.6 million) from the Aave lending protocol and deposited the assets into Coinbase eight hours ago, according to Lookonchain data. This daily crypto analysis examines whether this represents strategic accumulation or signals deeper market instability.

The transaction occurs against a backdrop of extreme fear, with the Crypto Fear & Greed Index registering 20/100. Market structure suggests institutional players are testing key liquidity zones while retail sentiment remains negative. Historical patterns indicate similar large transfers to centralized exchanges often precede volatility spikes, particularly when they involve former research firm executives whose trading patterns are closely monitored. The timing aligns with Ethereum's struggle to maintain support above the critical $2,850 Fibonacci level, a technical detail absent from the initial report but for understanding price action context.

Related developments in this extreme fear environment include analysis showing the Altcoin Season Index plunging to 16 and examination of Bitcoin's long-term value thesis being tested.

On-chain data indicates the address 0x7a9... (associated with Winslow Strong through previous transaction patterns and public wallet disclosures) executed two primary transactions at approximately 04:00 UTC on December 26. First, the address withdrew 307 CBBTC from Aave v3, representing the complete CBBTC position in that protocol. Second, it withdrew 1,900 ETH from the same lending pool. Both assets were transferred directly to known Coinbase deposit addresses within minutes, bypassing intermediate wallets. The total value of $32.6 million represents one of the largest single-entity transfers to a centralized exchange this week, according to blockchain analytics.

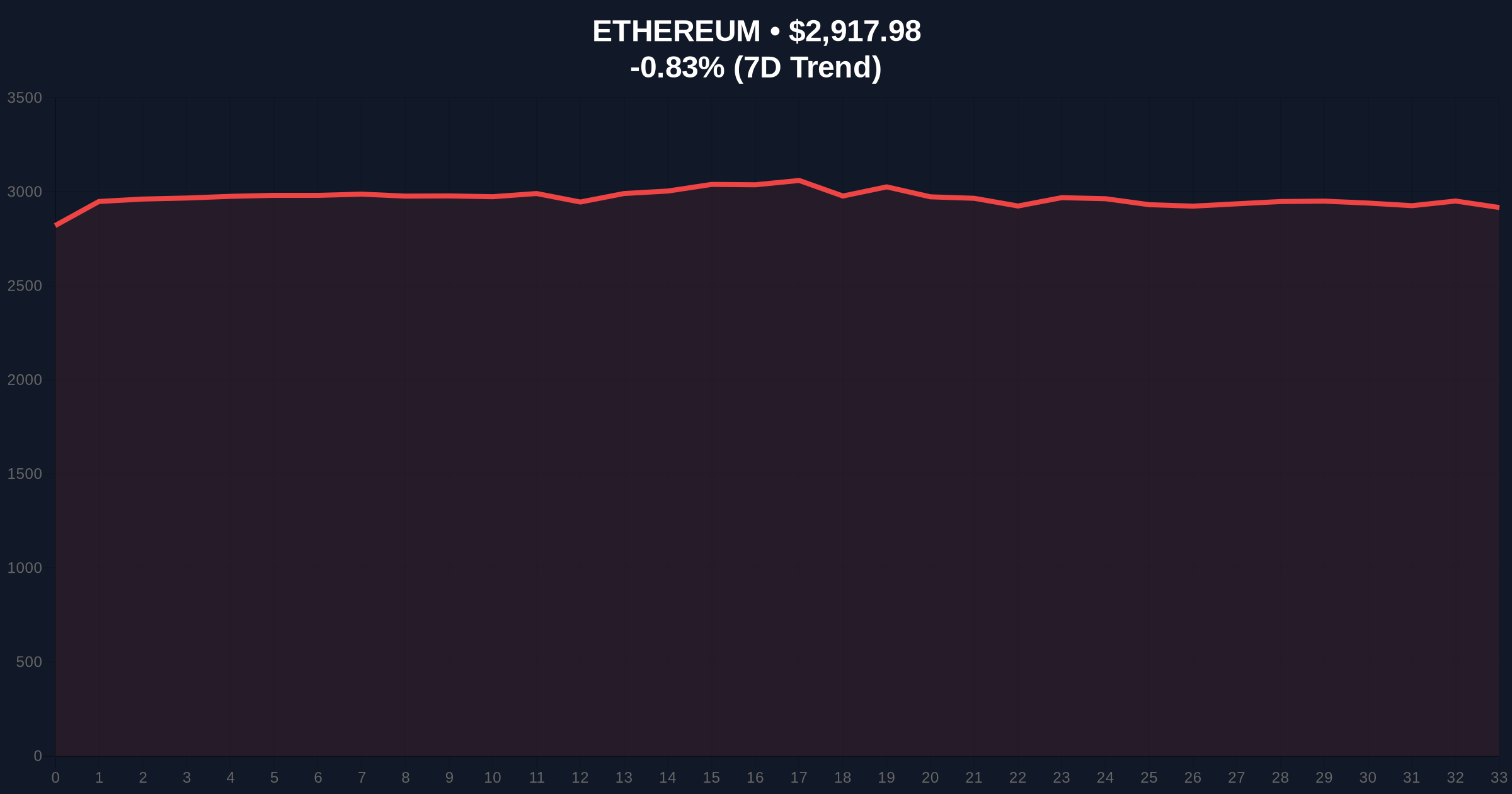

Ethereum's price action reveals concerning patterns. The asset currently trades at $2,917.63, down 0.84% in 24 hours. Volume profile analysis shows significant liquidity accumulation between $2,850 and $2,900, creating what technical analysts term an Order Block. The move below $2,900 earlier this week established a Fair Value Gap (FVG) that market structure suggests must be filled for healthy continuation. Relative Strength Index (RSI) sits at 42, indicating neither overbought nor oversold conditions, while the 50-day moving average at $3,120 provides overhead resistance. The transaction timing suggests Strong may be targeting this liquidity zone for what quantitative analysts describe as a potential Gamma Squeeze setup if volatility increases.

| Metric | Value |

|---|---|

| CBBTC Withdrawn | 307 ($27.03M) |

| ETH Withdrawn | 1,900 ($5.6M) |

| Total Transfer Value | $32.63M |

| Current ETH Price | $2,917.63 |

| 24h ETH Change | -0.84% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

For institutional participants, this transaction represents a test case for market efficiency during extreme fear conditions. The move from decentralized finance (DeFi) to centralized exchange (CEX) suggests either preparation for fiat conversion or strategic repositioning ahead of anticipated volatility. Retail impact is more psychological: large transfers to exchanges historically correlate with increased selling pressure, though correlation doesn't imply causation. Market structure suggests the true significance lies in whether this triggers follow-on selling from other large holders, creating what technical analysts call a Liquidity Grab below key support levels.

Industry observers express divided views. Some market analysts on X/Twitter frame this as "smart money accumulating during fear," pointing to Strong's research background. Others question the narrative, with one quantitative analyst noting: "Moving $32.6M to Coinbase during extreme fear either shows incredible conviction or preparation for exit. On-chain data indicates similar patterns preceded the March 2024 correction." The absence of official statement from Strong or Qualia Research leaves room for speculative interpretation, exactly what skeptical analysis seeks to avoid.

Bullish Case: If this represents accumulation rather than distribution, Ethereum could fill the FVG and test resistance at $3,050. Sustained buying above this level would invalidate bearish structure and target the 50-day MA at $3,120. Historical patterns indicate extreme fear readings often precede rallies when combined with large accumulation signals.

Bearish Case: If this triggers follow-on selling, Ethereum breaks the $2,850 Fibonacci support, targeting the next liquidity zone at $2,750. The Bullish Invalidation level sits at $2,800—a break below this on high volume would confirm distribution rather than accumulation. Bearish Invalidation occurs above $3,050, where short positions would face covering pressure.

What is CBBTC?CBBTC refers to Coinbase's wrapped Bitcoin token, representing Bitcoin collateralized on the Ethereum blockchain through Coinbase's institutional services.

Why move from Aave to Coinbase?Possible reasons include preparing for fiat conversion, securing assets ahead of anticipated protocol changes, or strategic repositioning between DeFi and CEX liquidity pools.

How does this affect Ethereum price?Large transfers to exchanges often increase available sell-side liquidity, potentially creating downward pressure if matched with market orders.

What is a Fair Value Gap (FVG)?A technical analysis concept where price moves so rapidly it leaves an imbalance between buy and sell orders that typically gets filled later.

Should retail investors follow this move?Market structure suggests copying large transactions without understanding context is risky. Historical data indicates mixed outcomes when retail follows institutional flows during extreme fear periods.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.