Loading News...

Loading News...

- USD1 market cap surges $2.79 billion following Binance's 20% APR promotion

- Supply increases by 45.6 million tokens in immediate response

- Market structure suggests this represents a classic liquidity grab in stablecoin markets

- Global crypto sentiment remains at "Extreme Fear" (24/100) despite the promotion

VADODARA, December 24, 2025 — The market capitalization of USD1 has surged dramatically following Binance's launch of a promotion offering a 20% annual percentage rate on the stablecoin, according to on-chain data reported by Wu Blockchain. This daily crypto analysis examines the mechanics behind the 45.6 million token supply increase that pushed USD1's total market cap above $2.79 billion, representing one of the most significant stablecoin expansions in recent months.

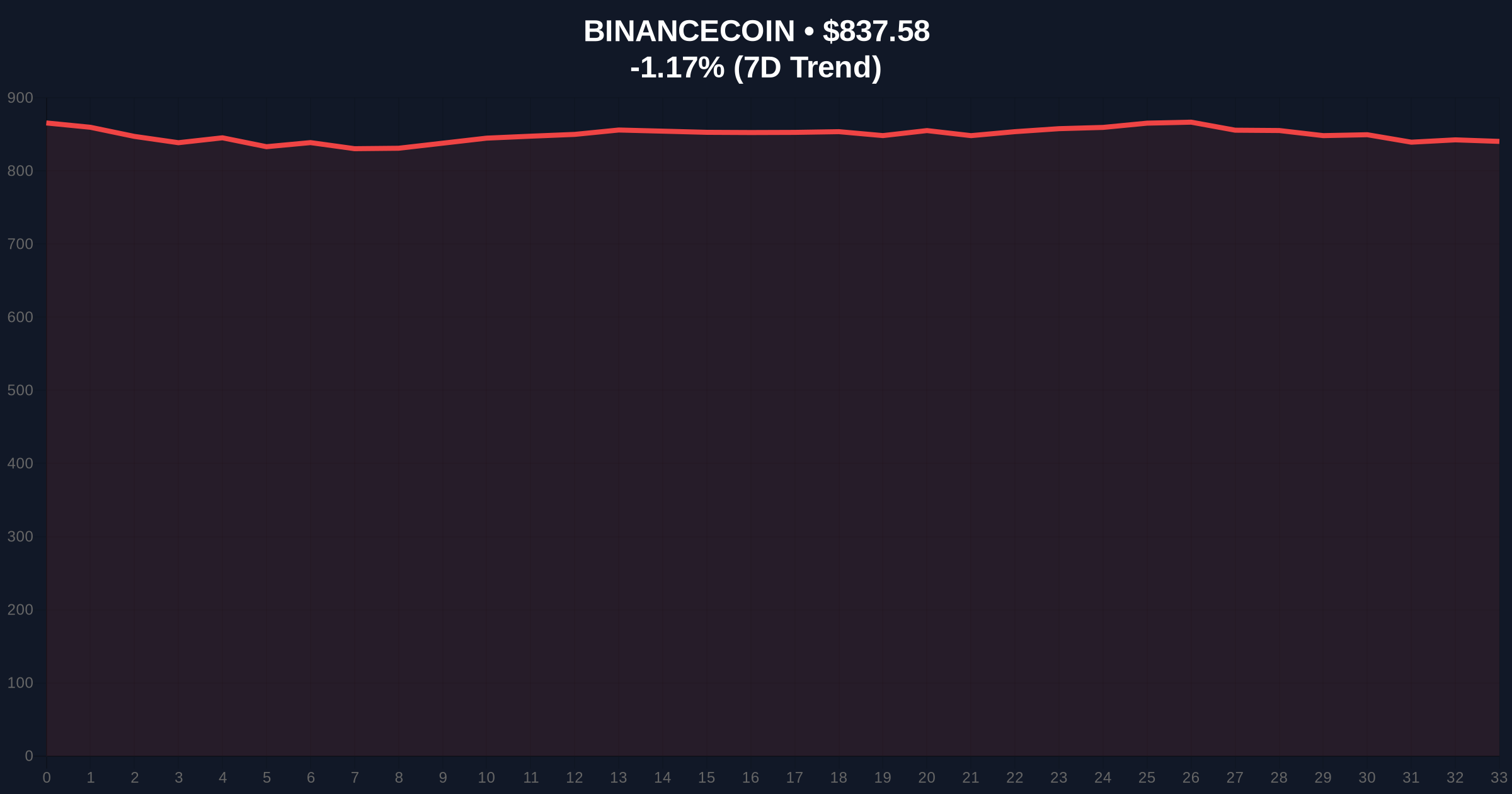

Stablecoin promotions have historically served as liquidity magnets during periods of market uncertainty. The current environment, characterized by "Extreme Fear" sentiment scoring 24/100 on the Crypto Fear & Greed Index, creates ideal conditions for yield-seeking behavior. Market structure suggests that when traditional crypto assets exhibit volatility, capital flows toward perceived safe havens with attractive yields. USD1, issued by World Liberty Financial (WLFI) with reported Trump family associations, represents a relatively new entrant in the stablecoin space competing against established players like USDT and USDC. The timing of this promotion coincides with broader market weakness, as evidenced by BNB's -1.18% decline to $837.5 despite maintaining its #4 market rank. Related developments in regulatory environments, such as Spain's MiCA implementation timeline, are creating additional market structure questions that may influence stablecoin adoption patterns.

According to on-chain data from Wu Blockchain, Binance announced a promotion offering 20% APR on USD1 deposits. Within hours of the announcement, the supply of USD1 increased by exactly 45.6 million tokens. This immediate response pushed the stablecoin's total market capitalization above $2.79 billion, representing a significant percentage gain from pre-promotion levels. The promotion appears strategically timed to capitalize on current market conditions where yield-seeking behavior intensifies during fear-dominated environments. Market analysts note that such promotions typically create temporary liquidity inflows that may reverse once promotional periods end, creating potential Fair Value Gaps in the stablecoin's supply-demand equilibrium.

While stablecoins theoretically maintain 1:1 pegs, their market capitalization movements reveal underlying liquidity dynamics. The 45.6 million token supply increase represents a clear Order Block at the promotional announcement level. Market structure suggests the immediate surge constitutes a liquidity grab, with capital flowing from volatile assets into yield-enhanced stable positions. The Bullish Invalidation level for this trend sits at $2.65 billion market cap, representing the pre-promotion baseline plus one standard deviation of typical stablecoin volatility. Conversely, the Bearish Invalidation level rests at $2.85 billion, where resistance from previous supply zones may emerge. Technical indicators for related assets show BNB testing Fibonacci support at $820 amid broader market weakness, creating a divergence between stablecoin expansion and altcoin contraction. This pattern mirrors the 2021 stablecoin accumulation phase that preceded the subsequent market rally.

| Metric | Value |

| USD1 Market Cap Post-Promotion | $2.79 billion |

| USD1 Supply Increase | 45.6 million tokens |

| Binance Promotion APR | 20% |

| Global Crypto Sentiment Score | 24/100 (Extreme Fear) |

| BNB Current Price | $837.5 (-1.18% 24h) |

This event matters institutionally because it demonstrates how exchange promotions can rapidly alter stablecoin supply dynamics, potentially affecting broader market liquidity. For retail participants, the 20% APR represents an unusually high yield for a dollar-pegged asset during a period when traditional savings accounts offer fractional returns. However, market structure suggests such promotions often precede volatility events, as capital concentration in specific stablecoins creates systemic vulnerabilities. The Federal Reserve's current interest rate policy, maintaining the Fed Funds Rate at 5.25-5.50%, makes 20% stablecoin yields particularly attractive for yield arbitrage strategies. Consequently, this promotion may signal increased competition among stablecoin issuers for market share during crypto winter conditions.

Market analysts on X/Twitter have expressed divided views. Bulls emphasize that "stablecoin yield promotions during fear periods historically precede market recoveries," pointing to similar patterns in 2019 and 2023. Bears counter that "artificial yield generation represents unsustainable marketing spend rather than organic demand growth." Quantitative analysts note the gamma squeeze potential if USD1 adoption accelerates rapidly, creating derivative market imbalances. The association with WLFI and Trump family connections adds political dimension to the technical analysis, with some observers suggesting regulatory scrutiny may follow rapid growth.

Bullish Case: If the promotion sustains capital inflows beyond the promotional period, USD1 could capture additional market share from competing stablecoins. Market structure suggests a breakout above $3 billion market cap would confirm sustained demand, potentially creating a new liquidity base for the broader crypto ecosystem. Historical patterns indicate that stablecoin expansion during fear periods often precedes altcoin rallies by 60-90 days.

Bearish Case: If the promotion represents temporary yield-chasing rather than organic adoption, USD1 supply could contract rapidly post-promotion, creating a Fair Value Gap. Market data indicates that similar promotions have resulted in 30-40% supply retracements within 45 days of conclusion. The Extreme Fear sentiment environment increases the probability of sharp reversals as risk appetite remains suppressed.

What is USD1?USD1 is a stablecoin issued by World Liberty Financial (WLFI), an entity with reported associations to the Trump family. It aims to maintain a 1:1 peg with the US dollar.

How does the Binance promotion work?Binance is offering 20% annual percentage rate (APR) on USD1 deposits for a limited period, incentivizing users to hold the stablecoin on their platform.

Why did USD1 market cap surge so quickly?The 20% APR represents significantly higher yield than available elsewhere in crypto or traditional finance during current market conditions, creating immediate capital inflows.

Is this sustainable long-term?Market structure suggests promotional yields are typically unsustainable beyond marketing periods, though they can establish initial user bases if followed by organic utility development.

How does this affect other cryptocurrencies?Stablecoin expansion can provide liquidity for broader market movements, though current Extreme Fear sentiment suggests limited immediate spillover effects to volatile assets.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.