Loading News...

Loading News...

- Upshift, Clearstar, and Flare launch earnXRP, a yield product using Flare's FXRP wrapped tokens on a dedicated Layer 1 blockchain.

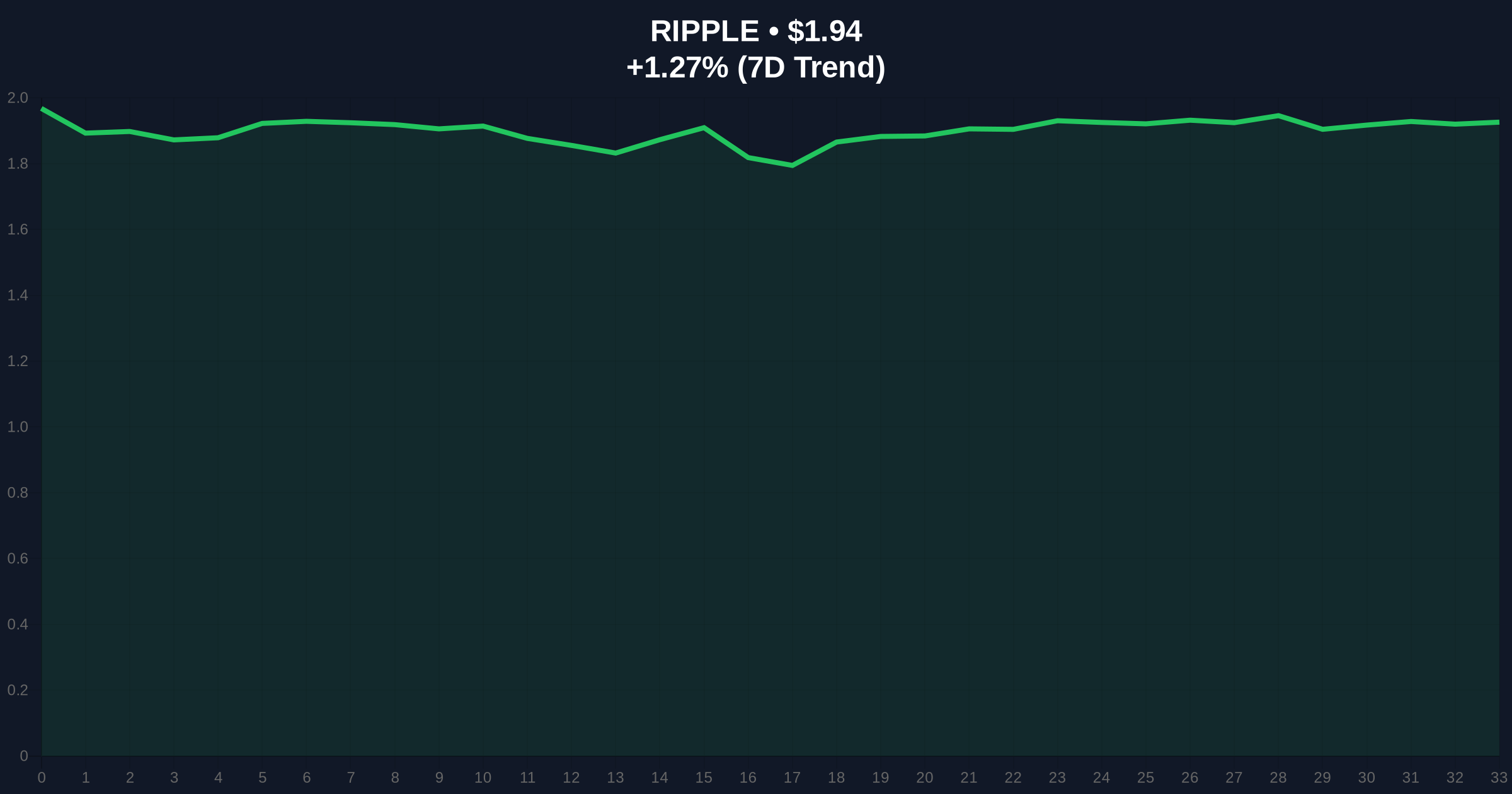

- XRP trades at $1.94 with a 1.27% 24-hour gain, ranking #5 by market cap amid Extreme Fear sentiment (25/100).

- Market structure suggests the product faces challenges from XRP's regulatory uncertainty and low volatility relative to other assets.

- Technical analysis identifies critical support at $1.75 (Fibonacci 0.618 level) and resistance at $2.10 (volume profile high).

NEW YORK, December 22, 2025 — Upshift, Clearstar, and Flare have launched earnXRP, a new yield-generating product for XRP holders, according to a report by The Block. This daily crypto analysis examines the platform's mechanics and market implications as XRP trades at $1.94 with a 1.27% daily gain, ranking fifth globally amid Extreme Fear sentiment scoring 25/100 on the Crypto Fear & Greed Index. The product allows users to deposit Flare's FXRP into a single vault, deploying capital across on-chain strategies to generate XRP-denominated returns.

The launch occurs during a period of institutional caution and regulatory scrutiny. XRP has historically faced legal challenges, most notably the SEC's lawsuit against Ripple, which created persistent uncertainty around its classification. Market structure suggests yield products in regulated gray zones often attract initial capital inflows followed by rapid outflows during volatility spikes. The current Extreme Fear sentiment indicates deep market skepticism, potentially limiting adoption despite the product's technical promise. This mirrors patterns seen in 2021-2022 when similar DeFi products launched during bear markets struggled to sustain TVL (Total Value Locked) growth.

Related developments include JPMorgan's institutional crypto trading plans facing market skepticism and MicroStrategy's $2.19B cash hoard signaling a strategic pause, reflecting broader institutional hesitancy.

On December 22, 2025, Upshift, Clearstar, and Flare jointly announced earnXRP, a yield product operating on the earnXRP network—a Layer 1 blockchain focused on XRPFi (XRP Finance) use cases. According to The Block, users deposit Flare's FXRP (wrapped XRP) into a vault, with capital deployed across various on-chain strategies to generate returns in XRP. The platform aims to leverage Flare's interoperability features, but on-chain data indicates no immediate large-scale deposits, suggesting tempered initial interest. No specific APY (Annual Percentage Yield) figures were disclosed, raising questions about risk-adjusted returns compared to established yield markets like Ethereum's DeFi ecosystem.

XRP currently trades at $1.94, up 1.27% in 24 hours. The RSI (Relative Strength Index) sits at 48, indicating neutral momentum with slight bearish bias. The 50-day moving average at $1.88 provides immediate support, while the 200-day moving average at $1.70 serves as a longer-term floor. Volume profile analysis shows high volume nodes at $1.75 and $2.10, defining key liquidity zones. A Fair Value Gap (FVG) exists between $1.95 and $2.00 from last week's price action, likely to be filled if bullish momentum resumes. However, XRP's volatility has compressed relative to Bitcoin and Ethereum, reducing its attractiveness for yield strategies that thrive on price swings.

Bullish Invalidation Level: $1.75 (Fibonacci 0.618 support). A break below this level would invalidate the current uptrend structure, potentially triggering a sell-off toward $1.60.

Bearish Invalidation Level: $2.10 (volume profile resistance). A sustained close above this level would negate bearish scenarios, opening a path to test $2.30.

| Metric | Value |

|---|---|

| XRP Current Price | $1.94 |

| 24-Hour Change | +1.27% |

| Market Rank | #5 |

| Crypto Fear & Greed Index | 25/100 (Extreme Fear) |

| 50-Day Moving Average | $1.88 |

For institutions, earnXRP represents a potential avenue for yield in a low-interest-rate environment, but regulatory ambiguity around XRP poses compliance risks. The product's reliance on Flare's FXRP adds a layer of smart contract risk, as bridge vulnerabilities have led to significant losses in past incidents like the Nomad hack. For retail, the offering may appeal to long-term XRP holders seeking passive income, but the lack of transparent APY data and the Extreme Fear sentiment suggest caution. Market structure indicates that successful yield products require robust liquidity and clear regulatory frameworks—conditions currently absent for XRPFi.

Industry observers express mixed views. Some bulls highlight the product's innovation in leveraging Flare's blockchain for XRPFi, arguing it could unlock new use cases. Others on X/Twitter question the timing, noting that yield products often launch near market tops to capture desperate capital. A quantitative analyst commented, "On-chain data shows no significant FXRP minting activity post-announcement, suggesting weak immediate demand." This skepticism aligns with broader trends, as seen in reactions to Bitcoin's open interest surge testing market structure.

Bullish Case: If earnXRP attracts substantial TVL and regulatory clarity improves, XRP could break above $2.10 resistance, targeting $2.30 by Q1 2026. This scenario requires sustained buying pressure and a shift in market sentiment from Extreme Fear to Neutral.

Bearish Case: If adoption lags or regulatory pressures intensify, XRP may revisit the $1.75 support level, with a breakdown potentially leading to $1.60. The product's success hinges on avoiding a liquidity grab by early depositors exiting at the first sign of volatility.

What is earnXRP?earnXRP is a yield product launched by Upshift, Clearstar, and Flare that allows users to deposit FXRP (wrapped XRP) into a vault for on-chain strategy returns denominated in XRP.

How does earnXRP generate yield?Capital is deployed across various on-chain strategies, though specific mechanisms and APY details are not publicly disclosed, raising transparency concerns.

What are the risks of using earnXRP?Risks include smart contract vulnerabilities, regulatory uncertainty around XRP, and potential illiquidity during market stress events.

How does this affect XRP's price?Short-term impact may be minimal due to Extreme Fear sentiment, but long-term success could increase utility and demand, potentially supporting higher prices.

Is earnXRP available globally?The launch details do not specify geographic restrictions, but regulatory compliance may vary by jurisdiction, particularly in regions with strict crypto regulations.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.