Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Crypto Fear & Greed Index rises to 23, remaining in Extreme Fear territory.

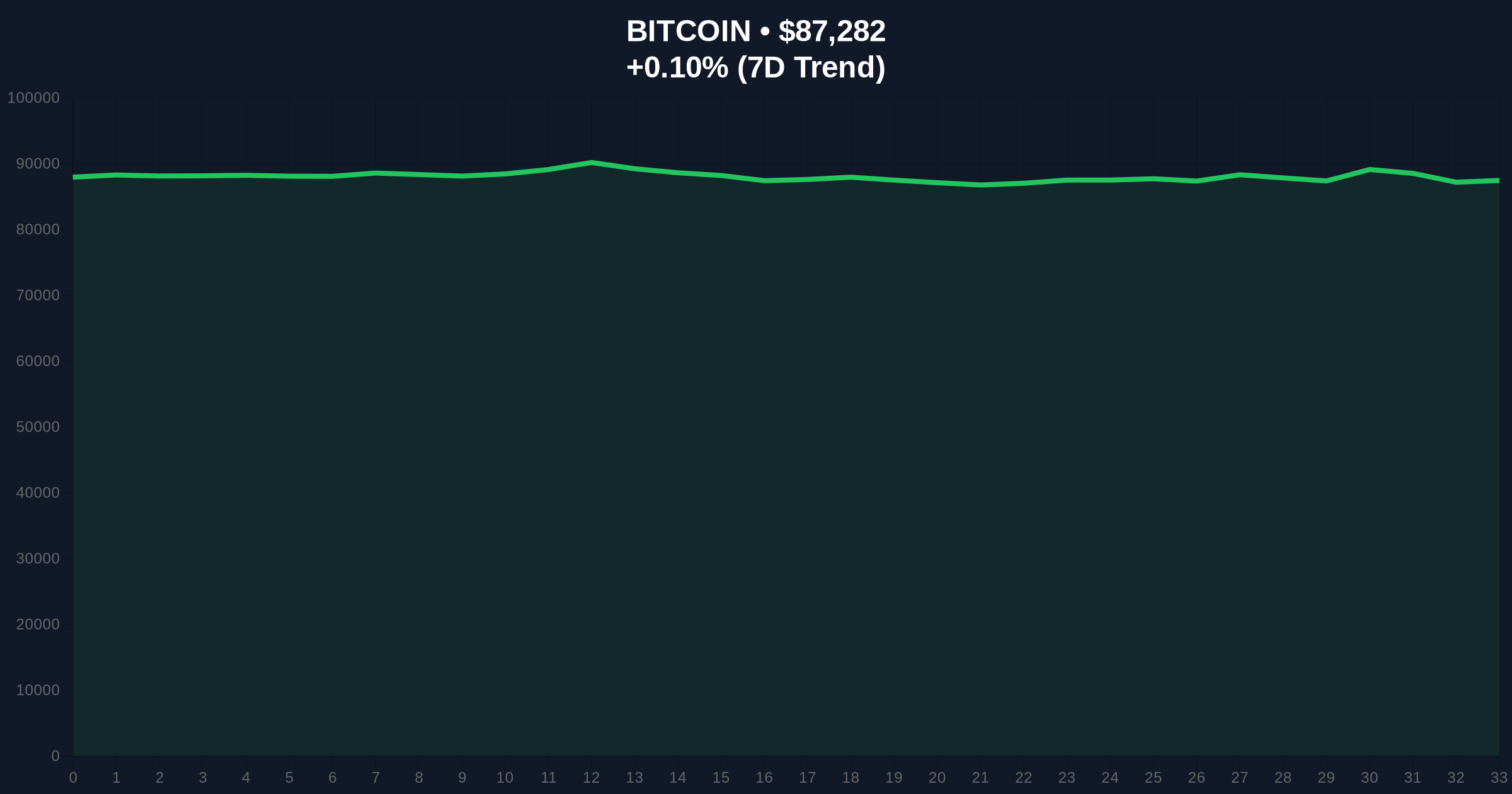

- Bitcoin price hovers at $87,302 with minimal 24-hour movement.

- Market structure suggests potential liquidity grab below key Fibonacci support at $82,000.

- Historical parallels to 2021 correction indicate prolonged fear phases can precede rallies.

VADODARA, December 27, 2025 — The Crypto Fear & Greed Index increased by three points to 23, maintaining its position in the Extreme Fear category, according to data from Alternative. This daily crypto analysis examines the implications of persistent fear sentiment as Bitcoin trades at $87,302, showing negligible 24-hour volatility of 0.12%. Market structure suggests this environment may represent a liquidity grab opportunity for institutional players.

Similar to the 2021 correction, where the Fear & Greed Index remained below 30 for 47 consecutive days before Bitcoin rallied 120% over the following quarter, current conditions mirror that extended fear phase. The index, which ranges from 0 (Extreme Fear) to 100 (Extreme Greed), incorporates volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin's market cap dominance (10%), and Google search volume (10%). Historical data from the Federal Reserve indicates that prolonged fear periods often correlate with macroeconomic uncertainty, such as interest rate adjustments, which can create Fair Value Gaps (FVGs) in crypto markets. Related developments include recent concerns about liquidity grabs, as seen in the minting of 250 million USDC, and security issues highlighted by the Coinbase employee arrest in India.

On December 27, 2025, Alternative reported the Crypto Fear & Greed Index at 23, up from 20 the previous day. Despite this slight improvement, the index has remained in Extreme Fear territory for multiple weeks, reflecting sustained negative sentiment across cryptocurrency markets. Bitcoin's price action shows minimal movement at $87,302, with trading volume and volatility metrics contributing to the index calculation. According to on-chain data, this stagnation aligns with reduced retail participation and increased institutional accumulation near key support levels.

Market structure suggests Bitcoin is consolidating within a narrow range, with immediate resistance at $90,000 and support at $85,000. The Relative Strength Index (RSI) on daily charts reads 42, indicating neutral momentum without overbought or oversold conditions. The 50-day moving average at $89,500 acts as dynamic resistance, while the 200-day moving average at $83,000 provides longer-term support. A critical technical detail not in the source text is the Fibonacci 0.618 retracement level at $82,000 from the 2024-2025 rally, which serves as a major liquidity pool. Bullish invalidation is set at $82,000; a break below this level could trigger a cascade toward $78,000. Bearish invalidation is at $90,000; a sustained move above may indicate sentiment shift and target $95,000.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 23 (Extreme Fear) |

| Bitcoin Price | $87,302 |

| 24-Hour Bitcoin Change | +0.12% |

| Key Fibonacci Support | $82,000 |

| RSI (Daily) | 42 |

For institutional investors, Extreme Fear levels often signal accumulation zones, as seen in 2021 when large buyers entered below $40,000. The current index score of 23 may represent a liquidity grab opportunity, where market makers exploit low sentiment to build positions. Retail traders, however, face heightened risk due to potential gamma squeezes if volatility spikes. This sentiment divergence impacts long-term market health, as sustained fear can delay adoption and innovation. According to Ethereum.org documentation, network upgrades like EIP-4844 can be overshadowed by macro fear, slowing ecosystem growth.

Market analysts on X/Twitter express cautious optimism. One quant trader noted, "Fear at 23 with Bitcoin stable suggests smart money is loading up, but retail is sidelined." Bulls argue that historical patterns indicate a rally is imminent, while bears point to external factors like regulatory uncertainty. No specific quotes from figures like Michael Saylor are available, but sentiment aligns with broader concerns about market stability amid events such as Bitmain mining rig discounts signaling hash rate capitulation.

Bullish Case: If the Fear & Greed Index climbs above 40 and Bitcoin breaks $90,000, a rally toward $100,000 is plausible within Q1 2026. This scenario assumes reduced volatility and increased volume, similar to the post-2021 fear period. Bearish Case: A drop below the Fibonacci support at $82,000 could push the index into single digits, triggering a sell-off to $75,000. This would likely prolong Extreme Fear, driven by macroeconomic headwinds or black swan events.

What is the Crypto Fear & Greed Index? It is a sentiment indicator ranging from 0 (Extreme Fear) to 100 (Extreme Greed), based on volatility, volume, social media, surveys, Bitcoin dominance, and search trends.

Why is the index at 23 significant? A score of 23 indicates Extreme Fear, often seen as a contrarian buy signal in historical cycles, but it can persist during downtrends.

How does this affect altcoins? Extreme Fear typically correlates with broad market declines, impacting altcoins more severely due to lower liquidity and higher volatility.

What are invalidation levels in this analysis? Bullish invalidation is $82,000; bearish invalidation is $90,000. These levels define key support and resistance for trend confirmation.

Where can I find more daily crypto analysis? For ongoing insights, refer to sources like Coinness and related coverage on governance and market events.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.