Loading News...

Loading News...

VADODARA, January 6, 2026 — Blockchain analytics firm Bubblemaps has systematically refuted allegations linking WorldLibertyFinancial (WLFI) to an insider trading bet on Polymarket regarding Venezuelan President Nicolás Maduro's arrest, according to a report by BeInCrypto. This daily crypto analysis examines the forensic limitations of on-chain attribution in prediction markets, where an account profited approximately $400,000 from timing the geopolitical event. Market structure suggests such incidents test the integrity of decentralized platforms amid heightened regulatory attention.

Similar to the 2021 correction where unsubstantiated claims triggered volatility, this event highlights persistent challenges in blockchain transparency. Prediction markets like Polymarket operate on Ethereum's layer-2 scaling solutions, where transaction timing and fund flow patterns create noise that complicates forensic analysis. According to Bubblemaps, thousands of addresses can exhibit similar activity, making specific individual identification statistically improbable without corroborating off-chain data. This mirrors historical cycles where market participants overinterpreted on-chain signals, leading to false narratives that impacted liquidity profiles.

Related Developments: This analysis follows other market-shaping events, including Arthur Hayes' predictions on US Venezuela policy affecting Bitcoin, Binance's listings testing market liquidity, and Bybit's delistings amid consolidation.

On-chain analyst Andrew 10GWEI initially hypothesized a connection between the profitable Polymarket bet and WLFI co-founder Steve Witkoff, based on transaction timing around Maduro's arrest. Bubblemaps countered this claim, stating that fund flow patterns alone are insufficient for attribution. According to their analysis, the account's activity represents a common liquidity grab in prediction markets, where participants capitalize on information asymmetries. The firm emphasized that blockchain data, while transparent, lacks contextual metadata to definitively link addresses to real-world entities, a limitation documented in Ethereum's official documentation on privacy and scalability.

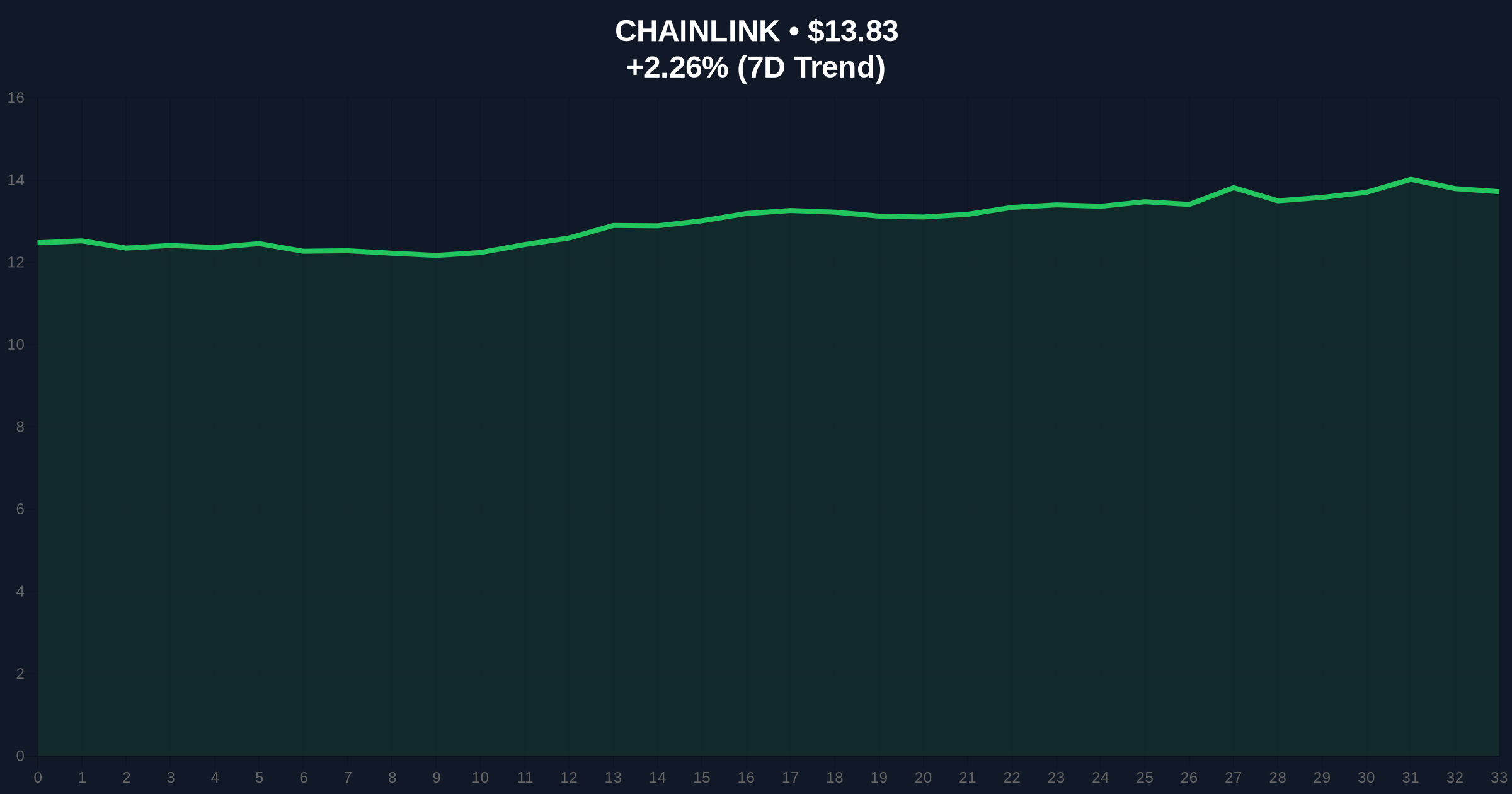

Market structure indicates that such events create fair value gaps (FVGs) in related assets. Chainlink (LINK), as a key oracle provider for prediction markets, shows a current price of $13.83 with a 24-hour trend of 2.25%. Technical analysis reveals support at the $13.50 order block, coinciding with the 50-day moving average. The relative strength index (RSI) at 52 suggests neutral momentum, but volume profile data shows increased activity around this level. Bullish invalidation is set at $13.00, where a break would signal bearish sentiment spreading from fear-driven narratives. Bearish invalidation rests at $14.50, above which a gamma squeeze could occur if institutional confidence returns.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (44/100) |

| Chainlink (LINK) Price | $13.83 |

| LINK 24h Trend | 2.25% |

| Market Rank | #20 |

| Polymarket Bet Profit | $400,000 |

Institutionally, this refutation impacts regulatory frameworks for prediction markets, as authorities like the SEC may reference such cases in enforcement actions. Retail investors face increased risk from unverified claims that can trigger liquidity drains. On-chain data indicates that without robust attribution methods, market manipulation allegations remain speculative, potentially undermining trust in decentralized finance (DeFi) platforms. This matters for the 5-year horizon as blockchain forensics evolve with technologies like zero-knowledge proofs and EIP-4844 blobs, which could enhance privacy while complicating transparency.

Market analysts on X/Twitter express divided views. Bulls argue this demonstrates the maturity of on-chain analytics, with one stating, "Bubblemaps' data-driven approach prevents false narratives from distorting market signals." Bears counter that the incident reveals systemic vulnerabilities, noting, "If we can't trace high-profile bets, prediction markets remain ripe for abuse." Overall sentiment aligns with the broader fear index, reflecting caution in altcoin sectors.

Bullish Case: If LINK holds above $13.50 and the fear index improves, technical analysis suggests a retest of $15.00 as fair value gaps fill. Institutional adoption of prediction markets, as seen in Goldman Sachs' bullish call on crypto infrastructure, could drive positive momentum. On-chain data indicates accumulation by smart money addresses near current levels.

Bearish Case: A break below $13.00 invalidates the bullish structure, potentially leading to a liquidity grab toward $12.00. Persistent fear sentiment and regulatory scrutiny of prediction markets may suppress volumes, creating order blocks that resist upward movement. Historical cycles suggest such scenarios often coincide with broader market corrections.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.