Loading News...

Loading News...

VADODARA, January 5, 2026 — Bitcoin traders are accumulating $100,000 strike call options for January expiry, with total open interest reaching $1.45 billion on Deribit, according to data from the exchange. This daily crypto analysis reveals a gamma squeeze scenario as funding rates exceed 30%, forcing options dealers into a short gamma position that requires dynamic hedging through BTC purchases. Market structure suggests this could amplify price movements if Bitcoin breaches key technical levels.

Similar to the 2021 bull run, where call option accumulation preceded significant volatility spikes, current positioning mirrors patterns observed during the Q4 2024 rally. Historical cycles indicate that when open interest for out-of-the-money calls surges, it often signals institutional anticipation of a liquidity grab. The current $828 million in January-expiring contracts represents a concentrated bet that could create a Fair Value Gap (FVG) if prices move rapidly. This development occurs alongside other market shifts, such as the $582 million inflow into digital asset funds despite prevailing fear sentiment, highlighting a contradiction in market behavior.

According to Deribit data, open interest for Bitcoin call options with a $100,000 strike price for January expiry stands at $1.45 billion, with $828 million maturing this month. In the last 24 hours, this open interest grew by 420 BTC. Analysis from QCP Capital, cited in the original report, indicates that demand for these options could surge if BTC surpasses $94,000. The firm noted that funding rates for BTC perpetual futures on Deribit have exceeded 30%, placing options dealers in a short gamma position. This forces them to buy BTC to hedge potential losses, creating a feedback loop that intensifies with rising prices.

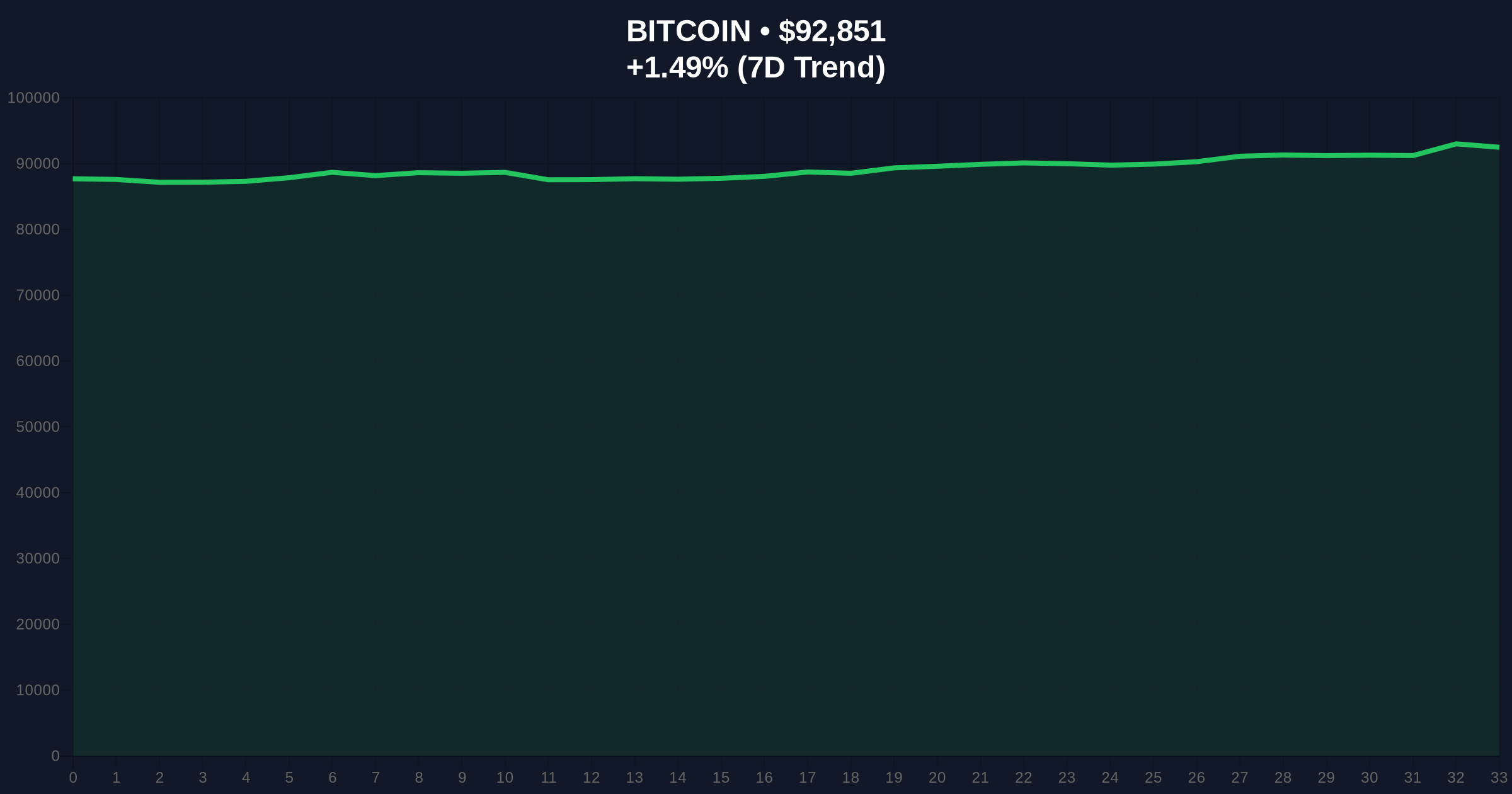

Bitcoin is currently trading at $92,835, up 1.47% in 24 hours. The Volume Profile indicates strong accumulation near the $90,000 support level, which aligns with the 0.618 Fibonacci retracement from the 2025 all-time high. A breach above $94,000 would invalidate the recent bearish order block and likely trigger the gamma squeeze described by QCP Capital. The Relative Strength Index (RSI) sits at 58, suggesting neutral momentum with room for upward movement. Bullish invalidation is set at $88,500, a level that would break the weekly support and negate the options-driven thesis. Bearish invalidation lies at $96,200, where resistance from the previous high could stall the rally.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $92,835 | Live Market Data |

| 24-Hour Trend | +1.47% | Live Market Data |

| Crypto Fear & Greed Index | Fear (Score: 26/100) | Live Market Data |

| $100K Call Options Open Interest | $1.45 billion | Deribit |

| January Expiry Value | $828 million | Deribit |

| 24-Hour Open Interest Change | +420 BTC | Deribit |

| BTC Perpetual Funding Rate | >30% | QCP Capital via Deribit |

For institutional traders, this gamma squeeze represents a systemic risk that could exacerbate volatility, impacting delta-neutral strategies and requiring recalibration of risk models. Retail investors may face amplified price swings, increasing the importance of stop-loss orders near invalidation levels. The scenario the growing influence of derivatives on spot markets, a trend documented in Federal Reserve research on derivatives and volatility. If the squeeze materializes, it could test market structure resilience, similar to recent events like the Bybit's BREX listing.

Market analysts on X/Twitter are divided. Bulls highlight the technical setup as a precursor to a breakout, citing the high funding rates as a sign of overheated speculation that could reverse sharply. Bears point to the Fear & Greed Index score of 26 as a contrarian indicator, suggesting that retail caution contrasts with aggressive institutional positioning. No direct quotes from figures like Michael Saylor are available, but sentiment leans toward cautious optimism given the options volume.

Bullish Case: If Bitcoin breaks above $94,000, the gamma squeeze could propel prices toward $100,000 by January expiry. Dealers' hedging buys would create sustained upward pressure, potentially filling the FVG up to $102,500. This would align with historical patterns where call option accumulation led to 15-20% rallies within expiry windows.

Bearish Case: Failure to hold $88,500 support could trigger a liquidation cascade, especially if the Fear sentiment deepens. Options dealers might unwind positions, amplifying downside moves toward $85,000. This scenario would mirror the 2022 downturn, where high gamma exposure exacerbated declines.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.