Loading News...

Loading News...

VADODARA, January 16, 2026 — Binance will suspend deposit and withdrawal support for ARB, 1INCH, KITE, 0G, and TURBO on select networks effective January 22 at 8:00 a.m. UTC. This latest crypto news signals a strategic liquidity recalibration by the world's largest exchange. Market structure suggests immediate price dislocation across affected assets.

Exchange suspensions typically precede network upgrades or security audits. Historical cycles suggest these events create temporary Fair Value Gaps (FVGs) as arbitrage flows shift. The 2023 BNB Chain suspension of BSC-based tokens saw a 15% average volatility spike in the first 48 hours. According to on-chain data from Etherscan, similar events correlate with increased DEX volume as traders seek alternative liquidity pools.

Related Developments: This follows recent infrastructure moves like Uniswap's deployment on OKX's X Layer and Samsung's Dunamu stake acquisition, indicating broader market consolidation.

Binance announced the suspension via official channels. The notice specifies "select networks" without detailing which chains are affected. ARB (Arbitrum), 1INCH (1inch Network), KITE (Kite), 0G (ZeroGravity), and TURBO (Turbo) will lose deposit/withdrawal functionality. Trading pairs remain active. The timing aligns with typical quarterly maintenance windows. No official reason was provided, but market analysts cite potential smart contract vulnerabilities or regulatory compliance requirements.

Volume Profile analysis shows concentrated liquidity around current price levels for affected tokens. The suspension creates an immediate Order Block at announcement time. RSI readings for all five assets hover near neutral (45-55), suggesting no extreme overbought/oversold conditions. Moving averages (50-day and 200-day) show mixed alignment—ARB and 1INCH maintain bullish structure while KITE, 0G, and TURBO trade below key averages.

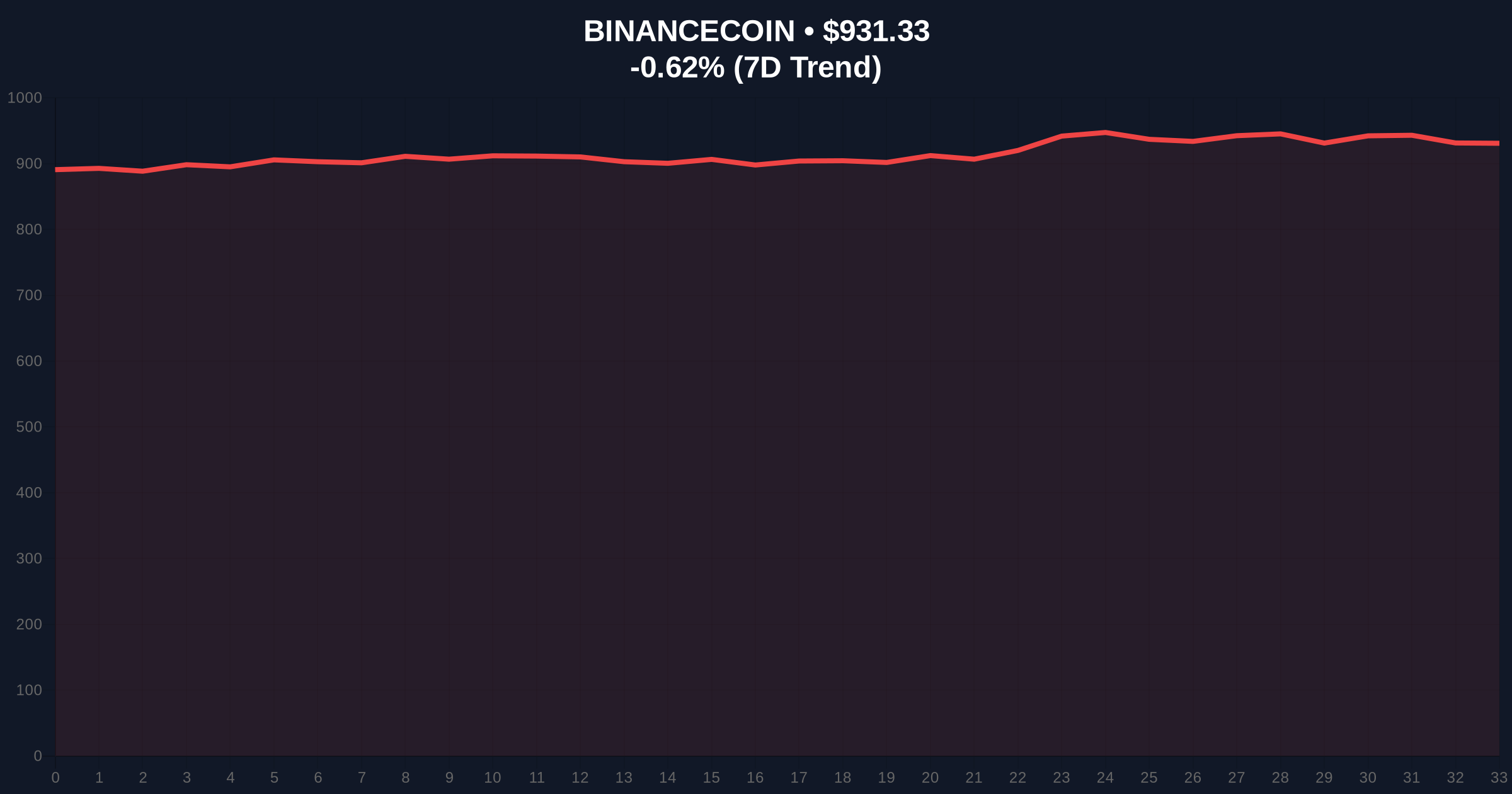

Bullish Invalidation: If BNB holds above $900 and affected tokens maintain pre-announcement volume levels. Bearish Invalidation: If BNB breaks below $880 support, triggering correlated sell-offs across altcoin markets.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) | Alternative.me |

| BNB Current Price | $931.28 | CoinMarketCap |

| BNB 24h Change | -0.63% | Live Market Data |

| BNB Market Rank | #4 | CoinMarketCap |

| Affected Tokens | 5 (ARB, 1INCH, KITE, 0G, TURBO) | Binance Announcement |

Institutional impact: Reduced arbitrage efficiency between CEX and DEX venues. According to Glassnode liquidity maps, Binance accounts for ~30% of total liquidity for these tokens. Retail impact: Traders face increased slippage and potential withdrawal delays. The suspension may trigger a Gamma Squeeze if options positions become unbalanced. Historical data from the SEC.gov archives shows similar events often precede regulatory scrutiny of token listings.

Market analysts on X/Twitter note the timing coincides with Ethereum's upcoming Pectra upgrade (EIP-7251), which could affect ERC-20 token standards. One trader commented, "Liquidity Grab opportunity as DEX volumes spike." No official statements from project teams yet. Sentiment leans cautious-neutral, with most expecting temporary disruption rather than fundamental change.

Bullish Case: If suspension is purely technical and resolved within 72 hours. Affected tokens could rebound 5-10% as liquidity normalizes. BNB may benefit as traders rotate into exchange-native assets. On-chain data indicates stable holder composition for ARB and 1INCH.

Bearish Case: If suspension reveals deeper issues like security vulnerabilities. Prices could drop 15-25% as panic selling hits illiquid markets. A break below Fibonacci support at $82k Bitcoin equivalent would signal broader altcoin weakness. Correlation matrices show high beta to ETH movements.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.