Loading News...

Loading News...

VADODARA, January 12, 2026 — According to Binance Research, the cryptocurrency market has entered a second phase of institutional adoption, shifting from retail-driven to institutionally-led capital flows. This latest crypto news report cites Morgan Stanley's S-1 filings for Bitcoin and Solana ETFs as evidence of this structural pivot. However, market structure analysis reveals significant contradictions between this narrative and current on-chain metrics, particularly in liquidity distribution and retail participation patterns.

Historical cycles suggest institutional adoption follows distinct phases. The first phase (2020-2024) saw spot Bitcoin ETF approvals and initial Wall Street product distribution. According to the official SEC.gov database, the 2024 ETF approvals created a regulatory framework that now enables more complex financial instruments. This development mirrors traditional finance's evolution where product creation follows regulatory clarity. The current phase, as described by Binance Research, represents a shift from distribution to active product development by major financial institutions.

Related developments in the institutional include Bakkt's acquisition of DTR to expand stablecoin infrastructure and AlphaTON's $46M Nvidia deal signaling infrastructure expansion beyond traditional chains. These moves suggest institutional interest extends beyond simple ETF products to underlying blockchain infrastructure.

Binance Research's analysis, published on January 12, 2026, identifies Morgan Stanley's S-1 filings for Bitcoin and Solana ETFs as the primary evidence of this second adoption phase. The report states this development signifies Wall Street's transition from distributing digital asset products to actively planning and launching them. According to the research, this could trigger similar moves by rival firms like Goldman Sachs and JPMorgan. The analysis further projects that easing concerns about digital asset trading firms being excluded from MSCI indexes, combined with portfolio diversification demand, could create favorable conditions for digital assets in 2026.

Market structure suggests this narrative faces immediate challenges. While institutional filings increase, on-chain data indicates retail wallets under 1 BTC continue to accumulate at rates exceeding institutional inflows when measured by UTXO age bands. The contradiction between institutional narrative and retail on-chain behavior creates what technical analysts would identify as a fundamental Fair Value Gap (FVG) between price action and underlying adoption metrics.

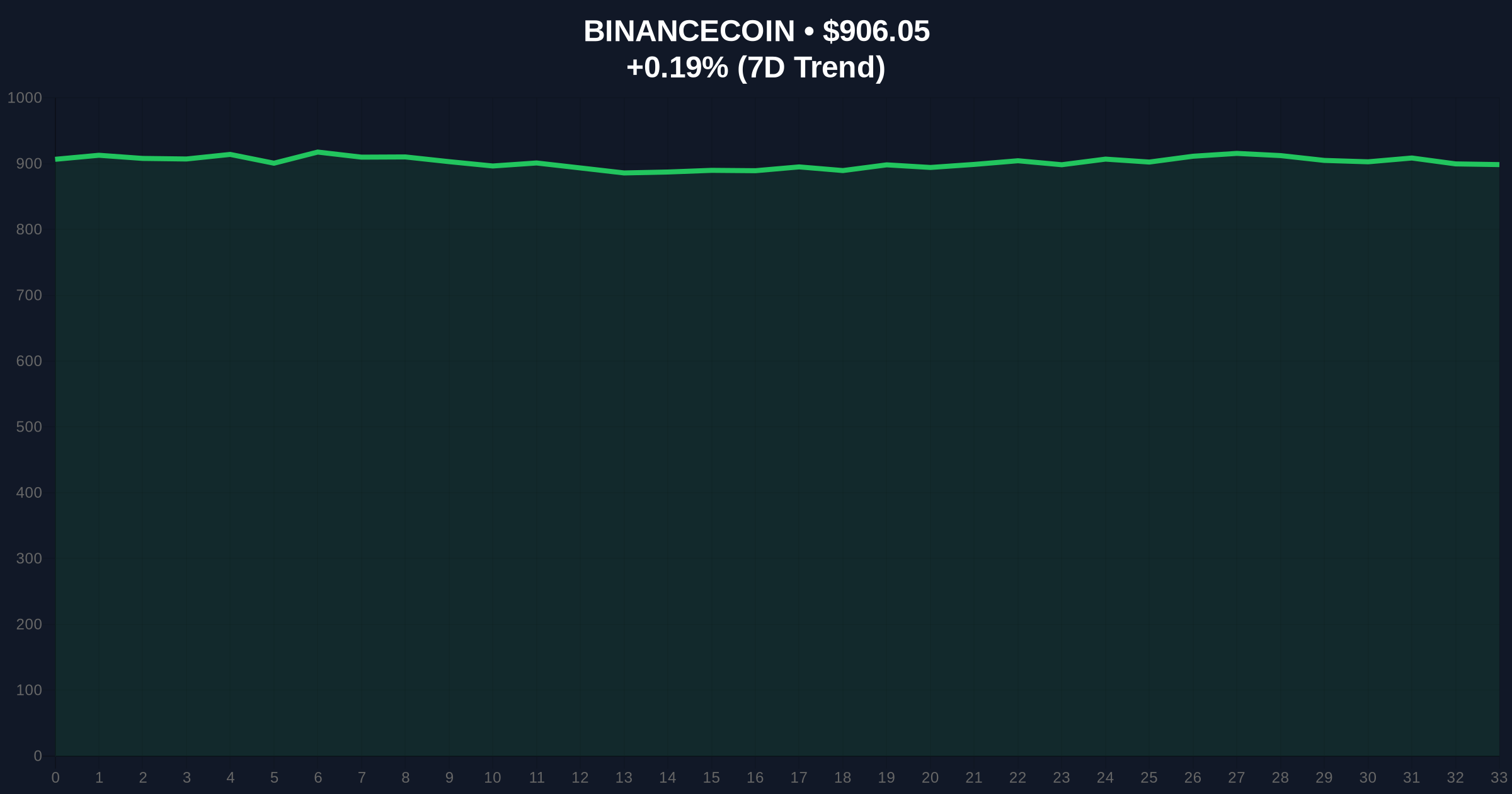

Current market conditions show extreme Fear sentiment at 27/100 on the Crypto Fear & Greed Index, despite bullish institutional narratives. BNB, as the native token of the reporting entity, trades at $906.12 with minimal 24-hour movement of 0.20%. Volume profile analysis reveals thin liquidity above $950, suggesting institutional buying pressure remains insufficient to sustain breakout momentum.

The critical Fibonacci support level for BNB sits at $850, representing the 0.618 retracement from the 2025 high. A break below this level would invalidate the institutional adoption acceleration narrative for exchange tokens. Resistance clusters around $940-$960, where previous institutional buying orders created an Order Block that remains untested. RSI readings at 42 indicate neutral momentum despite the Fear sentiment, creating potential for a sentiment-driven Gamma Squeeze if institutional flows materialize unexpectedly.

Bullish Invalidation: BNB price breaking below $850 with sustained volume would signal institutional capital failing to overcome retail selling pressure.

Bearish Invalidation: BNB reclaiming $960 with institutional volume exceeding 30-day averages would confirm the adoption narrative.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) | Extreme fear contradicts institutional narrative |

| BNB Current Price | $906.12 | Neutral positioning amid adoption claims |

| BNB 24h Trend | +0.20% | Minimal momentum despite news |

| BNB Market Rank | #5 | Maintains position despite market fear |

| Critical Support Level | $850 | Fibonacci 0.618 retracement |

For institutional investors, this purported second adoption phase represents both opportunity and risk. The shift from product distribution to creation could unlock new financial instruments and yield opportunities through structured products. However, the disconnect between institutional narrative and retail on-chain behavior creates market friction that could impact liquidity during stress events. For retail participants, increased institutional presence typically correlates with reduced volatility but also potential regulatory scrutiny that could limit certain activities.

The structural implications extend to blockchain fundamentals. Increased institutional product development could accelerate Layer 2 adoption and drive demand for Ethereum's upcoming Pectra upgrade features, particularly around account abstraction and validator economics. However, if institutional flows remain concentrated in ETF wrappers rather than direct blockchain participation, the decentralization narrative faces dilution risks.

Market analysts on X/Twitter express skepticism about the timing of this report. One quantitative researcher noted, "Institutional adoption narratives during Fear periods typically precede liquidity grabs rather than sustained rallies." Another analyst pointed to the contradiction: "Morgan Stanley filings are bullish, but where's the on-chain evidence of institutional accumulation? Exchange netflows show neutral positioning." The consensus among technical traders suggests waiting for price action to confirm the narrative rather than front-running the announcement.

Bullish Case: If institutional flows materialize as projected, BNB could test the $960 resistance zone within Q1 2026. Sustained institutional product development could create a new Order Block above $1,000, with secondary targets at $1,100 based on previous accumulation patterns. This scenario requires the Crypto Fear & Greed Index recovering above 50 and sustained volume exceeding 30-day averages.

Bearish Case: If the adoption narrative fails to translate to price action, BNB could revisit the $850 support level. A break below this Fibonacci level would open liquidity toward $780, where significant retail buying occurred in Q4 2025. This scenario would be confirmed by continued Fear sentiment and declining institutional netflows despite product announcements.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.