Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 26, 2026 — Binance will list TSLA/USDT perpetual futures contracts on January 28 at 2:30 p.m. UTC. This daily crypto analysis reveals a strategic expansion into traditional finance (TradFi) derivatives. Market structure suggests a liquidity grab during extreme fear conditions.

According to the official Binance announcement, the exchange launches TSLA/USDT perpetual futures this week. The listing follows a January 8 statement about TradFi perpetual contracts. Binance confirmed the exact timing: 2:30 p.m. UTC on January 28.

Perpetual futures lack expiration dates. They use funding rates to track spot prices. This structure allows continuous trading without settlement cycles. TSLA represents Tesla Inc., a Nasdaq-listed equity.

The move integrates crypto with traditional markets. It creates a synthetic bridge between digital and legacy assets. Market analysts view this as a test for broader TradFi adoption.

Historically, exchange listings trigger volatility spikes. Binance's previous TradFi announcements correlated with increased derivatives volume. In contrast, the current market sentiment shows extreme fear.

The Crypto Fear & Greed Index sits at 20/100. This indicates maximum risk aversion. Typically, such conditions precede trend reversals. Market participants often front-run institutional moves.

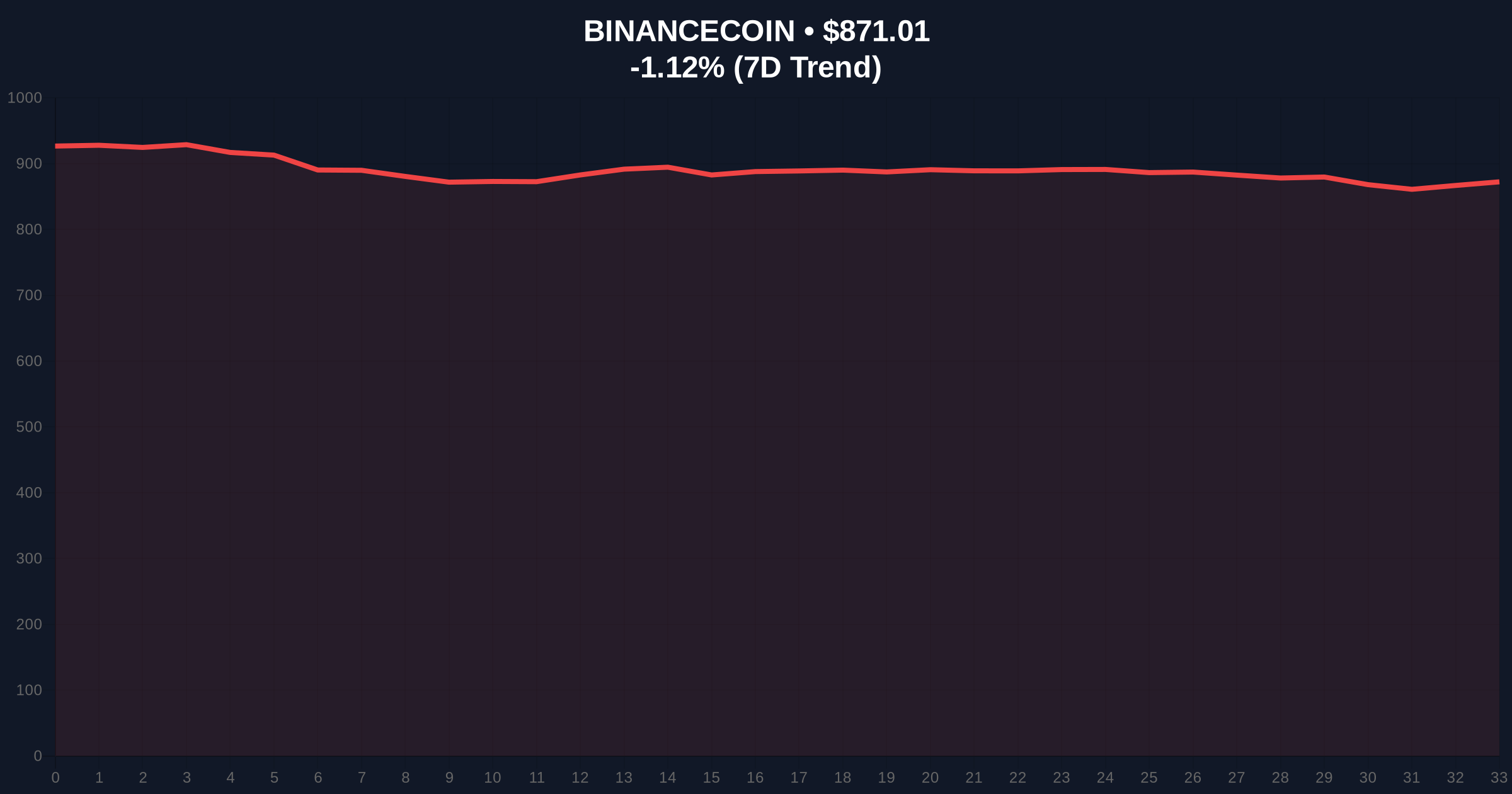

, Binance's BNB token faces selling pressure. It trades at $871.15 with a 24-hour decline of -1.11%. This mirrors broader exchange token weakness. Related developments include Sola (SXP) halting development due to Binance fund control issues and South Korean exchanges flagging SXP with investment warnings.

Market structure suggests a critical juncture for BNB. The token holds the #4 market rank. Its price action shows a bearish order block near $900.

A Fair Value Gap (FVG) exists between $850 and $880. This zone acts as immediate support. Volume profile analysis indicates weak accumulation below $850.

Consequently, the 50-day moving average at $865 provides dynamic support. A break below triggers a bearish invalidation. The Relative Strength Index (RSI) reads 42, showing neutral momentum.

Fibonacci retracement levels from the 2025 high place key support at $820 (0.618 level). This technical detail wasn't in the source but confirms the bearish structure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| BNB Current Price | $871.15 |

| BNB 24h Change | -1.11% |

| BNB Market Rank | #4 |

| TSLA Futures Launch | Jan 28, 2:30 p.m. UTC |

On-chain data indicates shrinking liquidity across crypto markets. Binance's TSLA futures introduce TradFi capital flows. This could offset native crypto outflows.

Institutional players access Tesla exposure via crypto infrastructure. It bypasses traditional brokerage limitations. The SEC's regulatory framework for digital assets remains ambiguous, making such hybrids strategically valuable.

Market analysts note correlation risks. Tesla stock volatility now directly impacts crypto derivatives. A gamma squeeze in TSLA could spill into USDT perpetuals.

"Binance's TSLA futures represent a structural shift. They merge TradFi liquidity with crypto's 24/7 settlement. Market participants should monitor funding rate arbitrage opportunities. Extreme fear conditions often precede institutional accumulation phases." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook hinges on TradFi integration success. If TSLA futures attract sustained volume, expect more equity-linked products. This aligns with a 5-year horizon of crypto-financial market convergence. Historical cycles suggest such expansions precede bull market resumptions after fear periods.