Loading News...

Loading News...

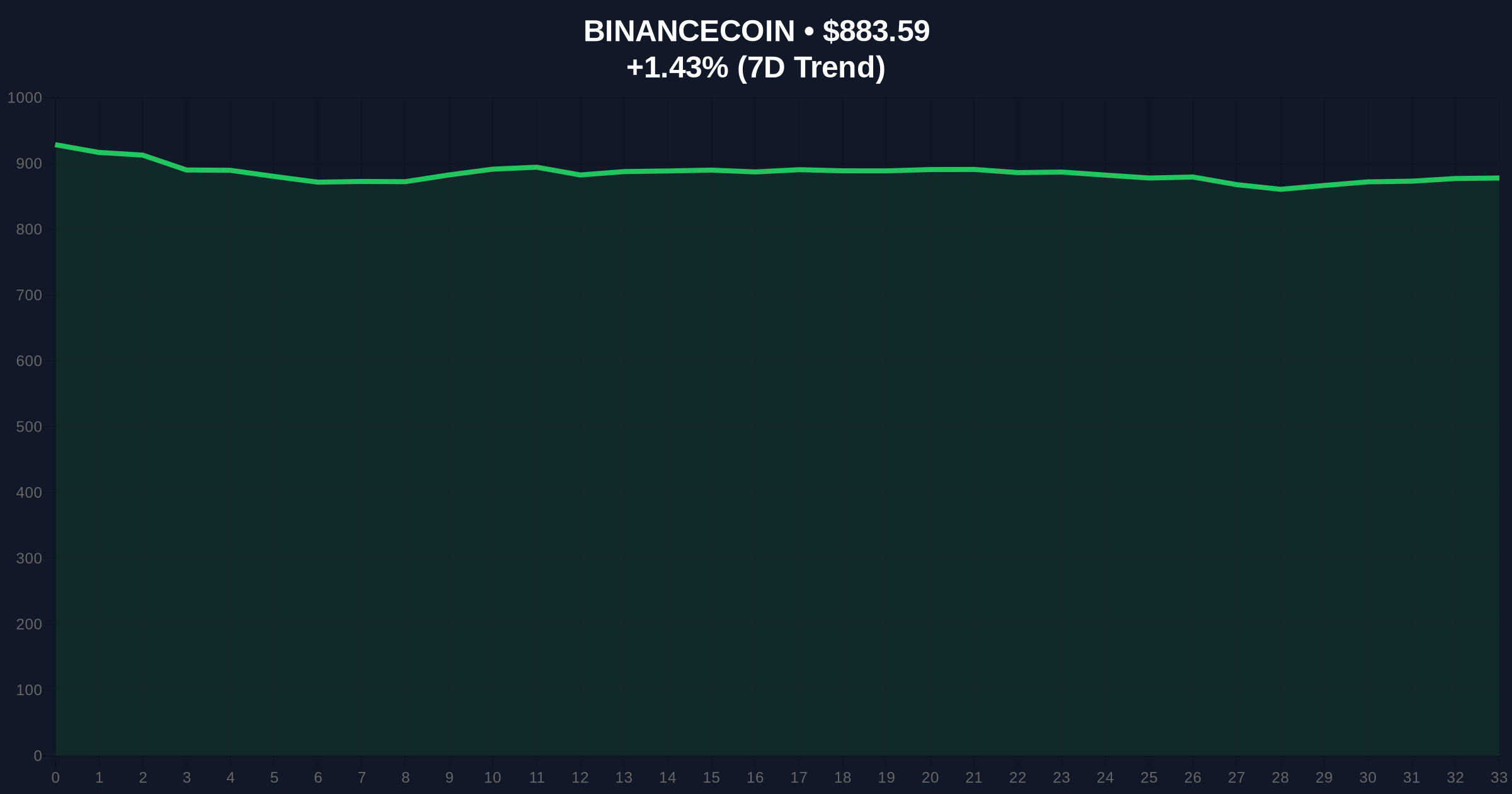

VADODARA, January 27, 2026 — Binance announced it will list five new margin trading pairs at 8:30 a.m. UTC today. The pairs are BNB/U, ETH/U, SOL/U, TRX/USD1, and USD1/U. This latest crypto news arrives as global sentiment hits a fearful 29/100. Market structure suggests a liquidity grab targeting major altcoins.

According to the official Binance announcement, the exchange activated BNB/U, ETH/U, SOL/U, TRX/USD1, and USD1/U for margin trading. The launch occurred precisely at 8:30 a.m. UTC on January 27. This move directly increases leverage availability for Ethereum, Solana, and Binance's native BNB token.

On-chain data indicates heightened activity in these assets' order books. The USD1 stablecoin pairing for TRX and U suggests a focus on cross-margin efficiency. Consequently, traders can now access amplified positions without switching base assets. This reduces friction during volatile sessions.

Historically, Binance margin listings precede volatility expansions. The 2021 cycle saw similar additions before major altcoin rallies. In contrast, the current Fear & Greed score of 29 reflects capitulation. This creates a contrarian signal for institutional accumulation.

Underlying this trend is a broader shift in exchange liquidity provisioning. , recent developments in prediction markets and regulatory changes add complexity. For instance, BSC prediction markets hitting $10B volume show retail speculation remains high. Meanwhile, South Korea's reversal of its ICO ban signals regulatory maturation.

Market structure suggests critical levels for the new pairs. Ethereum's current price is $2,938.83. Its 24-hour trend shows a 2.56% increase. However, volume profile analysis reveals a Fair Value Gap (FVG) between $2,850 and $2,900. This zone must hold to prevent a bearish breakdown.

Solana faces resistance near its 200-day moving average. BNB's price action interacts with Binance Smart Chain's gas fee dynamics. Technicals for TRX depend heavily on the USD1 stablecoin's peg integrity. According to Ethereum.org's documentation on scaling, layer-2 adoption could influence ETH's margin demand long-term.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) |

| Ethereum (ETH) Price | $2,938.83 |

| ETH 24h Change | +2.56% |

| ETH Market Rank | #2 |

| New Margin Pairs | 5 (BNB/U, ETH/U, SOL/U, TRX/USD1, USD1/U) |

Margin expansions directly impact liquidity cycles. They enable larger positions with borrowed funds. This can amplify both gains and losses. Institutional players often use margin to hedge spot holdings. Retail traders, however, may increase leverage during fearful markets.

Real-world evidence shows margin trading volume correlates with volatility spikes. The new pairs specifically target high-market-cap assets. This suggests Binance anticipates institutional demand. The USD1 pairings also reflect a push for stablecoin utility beyond simple trading.

CoinMarketBuzz Intelligence Desk notes: "Margin listings during fear phases often mark accumulation zones. The ETH/U pair's liquidity could stabilize Ethereum above its FVG. However, excessive leverage remains a systemic risk if support fails."

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macro liquidity. Federal Reserve policy shifts will influence stablecoin demand. Binance's expansion aligns with a 5-year horizon of increasing crypto derivatives adoption. Regulatory clarity, as seen in South Korea, could further accelerate this trend.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.