Loading News...

Loading News...

VADODARA, January 13, 2026 — Binance secured top positions in both spot and derivatives trading volume for 2025, according to Wu Blockchain's annual report on major centralized exchanges. This daily crypto analysis reveals structural dominance with spot volume approximately five times that of second-place Bybit. Market structure suggests a liquidity concentration event.

Centralized exchange volume distribution has historically signaled market health. The 2021 cycle saw Binance capture ~60% of spot volume. Current data indicates consolidation. This mirrors post-FTX collapse trends where liquidity migrated to perceived safer venues. Regulatory clarity, as outlined in the SEC's latest framework on digital assets, has pressured smaller exchanges. Related developments include JPMorgan's hawkish rate forecast impacting volatility and Bitcoin perpetual futures nearing equilibrium.

According to Wu Blockchain's report, the top four exchanges by spot trading volume were Binance, Bybit, Gate.io, and Crypto.com. Binance's spot volume was approximately five times Bybit's. In derivatives, Binance led followed by OKX, Bybit, and Bitget. No specific volume figures were disclosed. The data implies a significant Fair Value Gap (FVG) in liquidity between Binance and competitors.

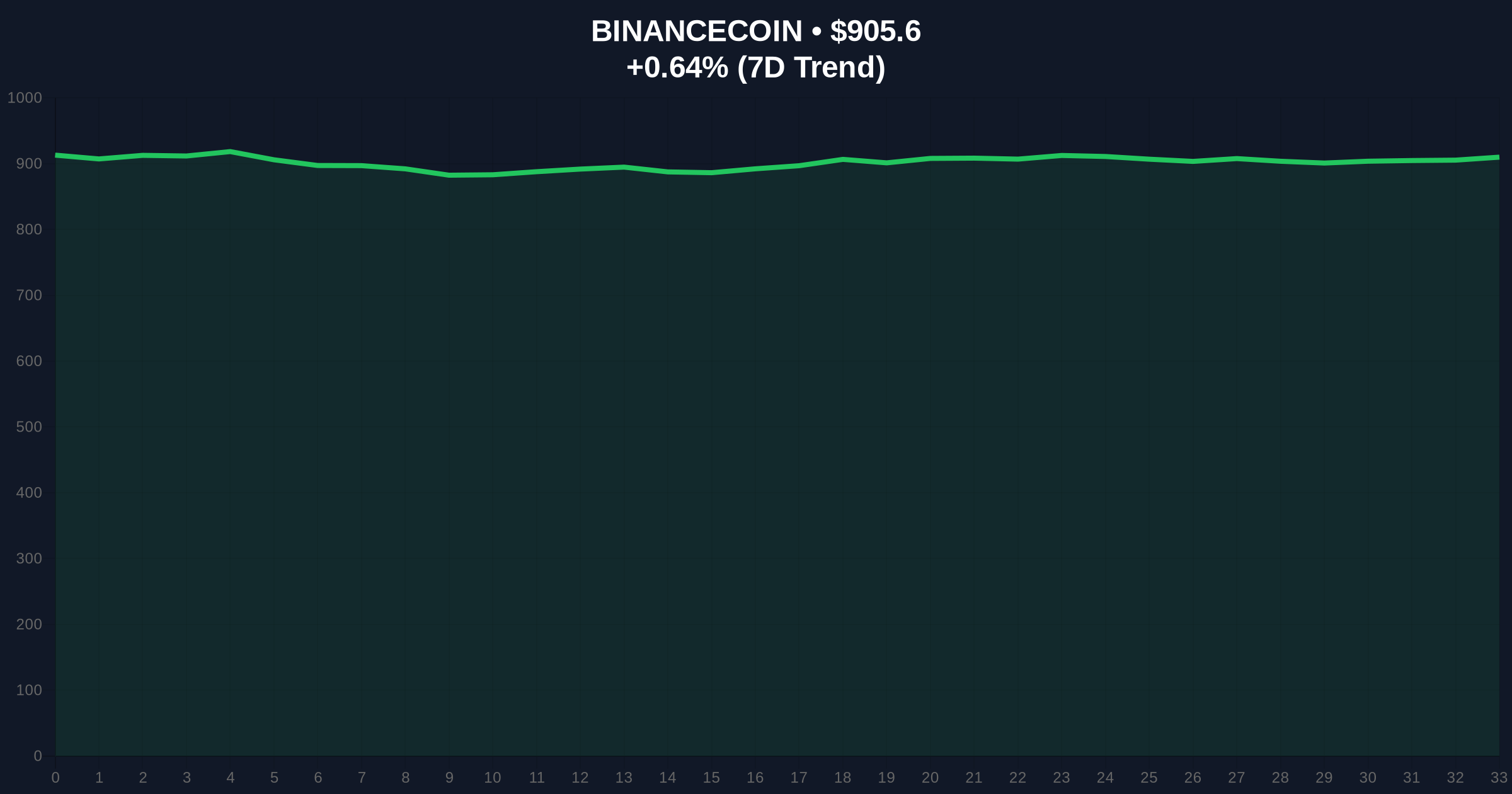

BNB, Binance's native token, trades at $905.41. The 24-hour trend shows a slight increase of 0.62%. Volume profile analysis indicates accumulation near the $900 level. Key support resides at the 200-day moving average of $850. Resistance is seen at the yearly high of $950. RSI sits at 55, suggesting neutral momentum. Bullish invalidation: A break below $850 would signal loss of structural support. Bearish invalidation: A sustained move above $950 could trigger a gamma squeeze.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (26/100) |

| BNB Current Price | $905.41 |

| BNB 24h Change | +0.62% |

| BNB Market Rank | #5 |

| Spot Volume Lead (Binance vs. Bybit) | ~5x |

For institutions, concentrated liquidity reduces slippage and enhances execution. It also centralizes counterparty risk. Retail traders face higher dependency on a single platform's stability. The dominance may influence regulatory scrutiny, as seen in past Order Block investigations. Long-term, this could slow decentralization efforts if CEX dominance persists.

Market analysts note Binance's resilience post-legal settlements. Bulls argue the volume lead validates its infrastructure. Bears warn of systemic risk from over-concentration. On-chain data indicates no major whale movements from Binance wallets, suggesting holder confidence. Sentiment aligns with neutral technicals despite global fear metrics.

Bullish Case: BNB breaks $950 resistance, targeting $1,100 as network effects drive demand. Binance's dominance sustains, attracting institutional flows. Derivatives volume grows with new product launches like EIP-4844-based options.

Bearish Case: Regulatory pressure intensifies, forcing Binance to reduce services. BNB loses $850 support, falling to $750. Competitors like Coinbase gain market share via regulatory compliance. A liquidity grab occurs if fear persists.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.