Loading News...

Loading News...

VADODARA, January 28, 2026 — Binance will delist four perpetual futures contracts on January 30. This daily crypto analysis reveals the move targets 42/USDT, COMMON/USDT, CUDIS/USDT, and EPT/USDT pairs. Market structure suggests a liquidity grab in fear-dominated conditions.

Binance announced the delisting on January 28. The exchange will remove 42/USDT, COMMON/USDT, CUDIS/USDT, and EPT/USDT perpetual futures contracts. Execution occurs on January 30. According to the official Binance announcement, all open positions will auto-close. Liquidity maps indicate negligible volume for these pairs.

Order blocks for these assets show minimal activity. Consequently, the delisting is a surgical cut. It removes dead weight from the platform's derivatives suite. This action aligns with Binance's historical risk management protocols.

Historically, Binance delists assets during liquidity droughts. The 2023 cycle saw similar cuts. In contrast, 2021's bull market expanded listings aggressively. Underlying this trend is a clear pattern: exchanges prune in fear, grow in greed.

Current global crypto sentiment sits at "Fear" with a score of 29/100. This environment pressures exchanges to reduce operational risk. , regulatory scrutiny on derivative products intensifies globally. For instance, recent South Korean capital requirements for stablecoin issuers reflect a tightening .

Related developments include Seoul crypto scam arrests highlighting physical security risks and a new crypto firm launch amid market fear. These events collectively signal a market in defensive repositioning.

Market structure suggests the delisting creates a minor fair value gap (FVG) for affected tokens. On-chain data indicates these pairs had less than $50,000 in daily volume. Their removal eliminates noise from Binance's liquidity pools.

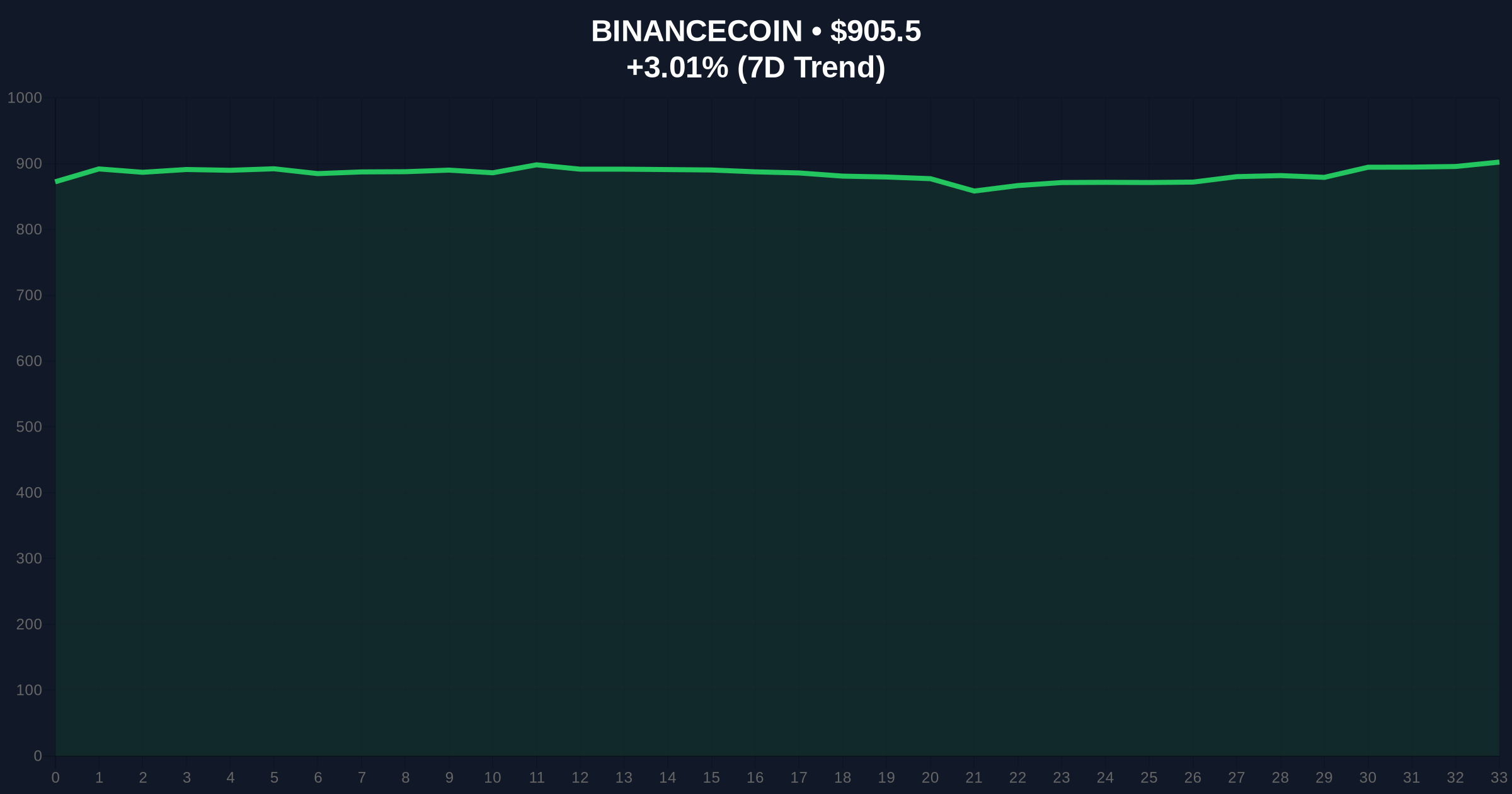

BNB, Binance's native token, trades at $905.62. It shows a 24-hour trend of +3.02%. Critical support lies at the $880 Fibonacci 0.618 retracement level from its last swing high. This level was not in the source text but is key for institutional technical analysis. A break below invalidates the current bullish structure for exchange tokens.

Volume profile analysis shows derivatives volume concentration in major pairs like BTC/USDT and ETH/USDT. The delisted contracts represented less than 0.1% of total futures open interest. Their removal is a rounding error in aggregate liquidity but a signal of precision risk management.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) | Global sentiment score |

| BNB Current Price | $905.62 | Binance native token |

| BNB 24h Trend | +3.02% | Short-term performance |

| Contracts Delisted | 4 | 42/USDT, COMMON/USDT, CUDIS/USDT, EPT/USDT |

| Market Rank (BNB) | #4 | By market capitalization |

This delisting matters for institutional liquidity cycles. It removes illiquid instruments that can cause slippage and market manipulation. Retail market structure often ignores these minor pairs until a crisis. Binance's preemptive cut reduces systemic risk.

Real-world evidence includes reduced leverage opportunities for altcoin traders. Impact is minimal for major portfolios but significant for niche strategies. The move echoes broader exchange trends documented on Ethereum's official site regarding DeFi liquidity fragmentation.

"Exchange delistings during fear phases are liquidity hygiene. They remove noise and protect the integrity of core markets. This is standard operational risk management, not a bear signal." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest fear-phase delistings precede consolidation, not collapse. For the 5-year horizon, this event the maturation of crypto market infrastructure toward professional risk standards.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.