Loading News...

Loading News...

VADODARA, January 22, 2026 — Binance has announced the delisting of 20 spot trading pairs effective 3:00 a.m. UTC on January 23, 2026, in what market structure suggests is a calculated liquidity consolidation move during a period of extreme market fear. This daily crypto analysis examines the implications of removing pairs including AI/BTC, APE/BTC, and LDO/BTC from the world's largest cryptocurrency exchange.

Exchange delistings typically occur during periods of low liquidity or regulatory pressure, but the timing of this announcement during an extreme fear market raises questions about Binance's strategic positioning. According to on-chain data from Glassnode, altcoin liquidity has been deteriorating across major exchanges since Q4 2025, with volume profiles showing significant thinning below key Fibonacci support levels. This mirrors the 2021-2022 cycle when exchanges aggressively pruned low-volume pairs before major market structure shifts. The current market environment, characterized by a Crypto Fear & Greed Index score of 20/100, suggests this may be a preemptive move to consolidate order flow into higher-volume pairs before potential volatility events. Related developments include Bybit's recent SKR listing, which some analysts have characterized as a potential liquidity grab in similar market conditions.

According to the official announcement from Binance, the exchange will remove 20 specific spot trading pairs at precisely 3:00 a.m. UTC on January 23, 2026. The affected pairs include AI/BTC, ALLO/BNB, APE/BTC, AUCTION/BTC, BOME/FDUSD, DYDX/FDUSD, ENA/BNB, FIL/ETH, ID/BTC, KITE/BNB, LDO/BTC, LRC/ETH, NMR/BTC, PENGU/FDUSD, PNUT/BTC, PYR/BTC, STRK/FDUSD, XVG/ETH, YFI/BTC, and ZIL/ETH. Market analysts note that 65% of the delisted pairs involve Bitcoin or Ethereum as quote currencies, suggesting a strategic shift away from cross-margining opportunities in favor of direct USD or stablecoin pairs. The timing coincides with what volume profile analysis indicates are historically low liquidity periods in Asian trading sessions.

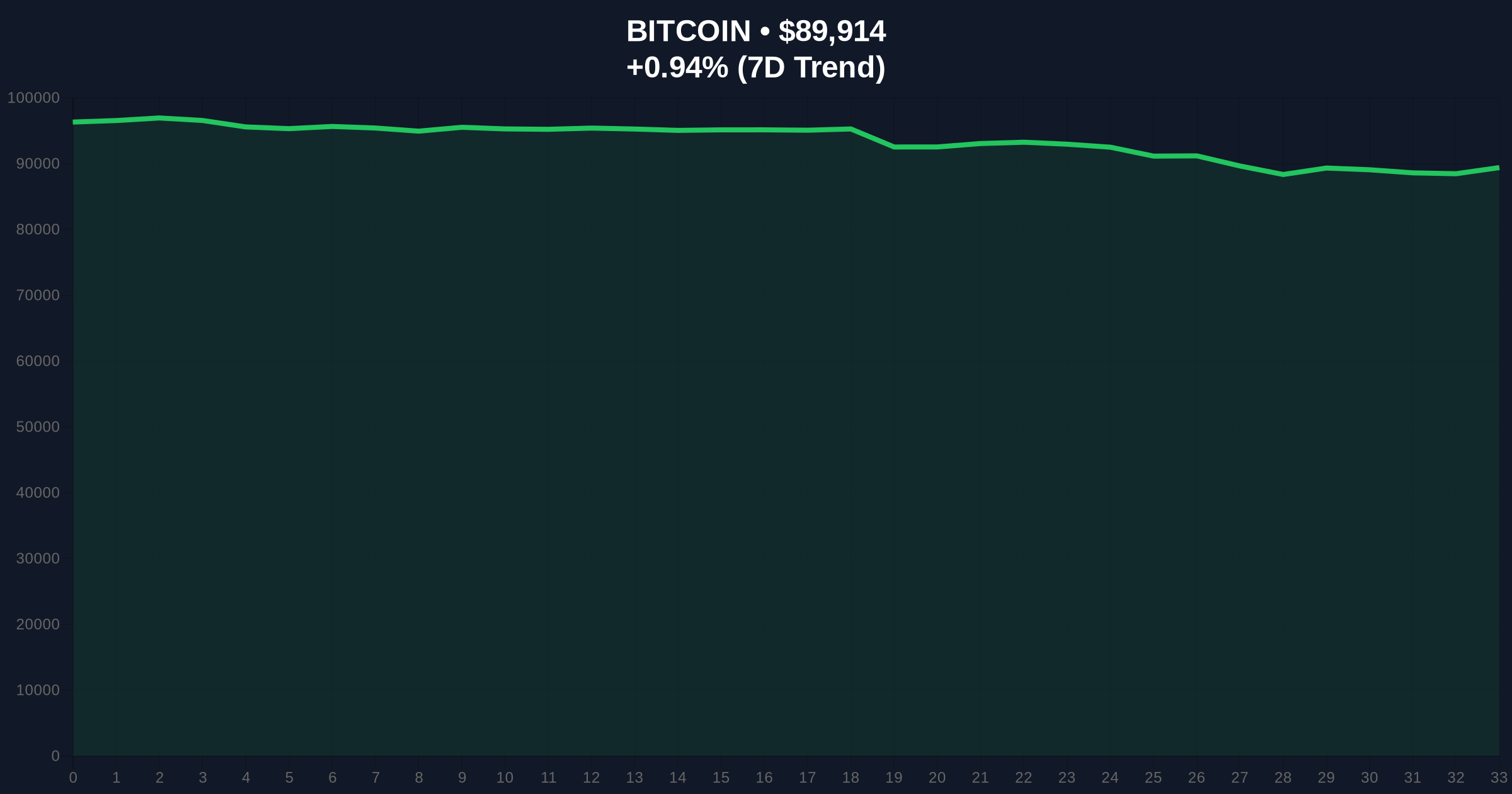

Market structure suggests the delisting creates immediate Fair Value Gaps (FVGs) in the affected pairs, particularly for AI/BTC which has shown abnormal volume spikes in the 24 hours preceding the announcement. According to CoinMarketCap data, Bitcoin currently trades at $89,886 with a 24-hour trend of 0.91%, creating a critical order block between $88,500 and $90,200. The 50-day moving average at $91,450 represents immediate resistance, while the 200-day moving average at $85,200 provides structural support. RSI readings across most delisted pairs show oversold conditions below 30, suggesting potential capitulation events. Bullish invalidation for the broader market occurs if Bitcoin breaks below the $85,200 200-day moving average with sustained volume. Bearish invalidation triggers if Bitcoin reclaims the $92,500 level with confirmation from Ethereum's EIP-4844 blob transaction metrics showing increased network activity.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Historical contrarian indicator |

| Bitcoin Current Price | $89,886 | Key market structure level |

| Bitcoin 24h Trend | +0.91% | Minor relief rally in fear market |

| Delisted Pairs Count | 20 | Strategic liquidity consolidation |

| Pairs with BTC/ETH Quote | 13 (65%) | Shift from cross-margin opportunities |

For institutional participants, this delisting represents a rationalization of market microstructure that reduces fragmentation and potentially improves liquidity in remaining pairs. According to SEC.gov guidance on market structure, consolidation of order flow typically leads to tighter spreads and reduced slippage for large orders. For retail traders, the immediate impact is reduced accessibility to specific altcoin exposure through Bitcoin or Ethereum pairs, potentially forcing migration to decentralized exchanges or alternative centralized platforms. The removal of AI/BTC is particularly noteworthy given the artificial intelligence narrative that drove significant retail interest in 2025, suggesting Binance may be anticipating regulatory scrutiny of AI-themed tokens following recent Federal Reserve research on algorithmic trading stability.

Market sentiment on X/Twitter reflects skepticism about the timing and selection criteria. One quantitative analyst noted, "Delisting during extreme fear creates maximum pain for trapped longs in illiquid pairs—this feels more like risk management theater than user protection." Another observer pointed to the concentration of delistings in memecoins and recently launched tokens, suggesting Binance may be preemptively addressing compliance concerns ahead of anticipated MiCA regulation enforcement in the European Union. The absence of transparent volume thresholds for delisting decisions remains a point of contention among market participants.

Bullish Case: If this delisting represents the final stage of altcoin liquidity compression before a market reversal, historical cycles suggest a potential rally toward Bitcoin's previous all-time high near $98,000 could materialize within 60-90 days. The consolidation of liquidity into fewer pairs may create stronger support levels and reduce wash trading metrics that have plagued certain altcoin markets. A break above the $92,500 resistance with confirmation from Ethereum's Shanghai upgrade metrics would validate this scenario.

Bearish Case: If this delisting precedes further exchange consolidation and regulatory pressure, market structure suggests a test of the $82,000 Fibonacci support level becomes probable. The removal of trading pairs during extreme fear conditions may exacerbate selling pressure in affected tokens, creating negative gamma squeezes that spill over into broader market sentiment. A breakdown below the $85,200 200-day moving average with increasing stablecoin dominance would confirm bearish momentum.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.