Loading News...

Loading News...

VADODARA, January 5, 2026 — Binance has announced it will list the BREV token and select it for its next Hodler Airdrop, a move that market structure suggests may represent a calculated liquidity grab rather than organic growth. This daily crypto analysis examines the announcement against contradictory market data, including extreme fear sentiment and BNB's precarious technical position.

Exchange listings during periods of market fear historically create asymmetric opportunities for both retail traders and institutional players. According to Glassnode liquidity maps, similar announcements in Q4 2025 resulted in immediate price pumps followed by significant retracements as market makers capitalized on retail FOMO. The current environment mirrors the 2021 correction phase where exchange-driven narratives often masked underlying weakness in UTXO age distribution and on-chain volume. Related developments include Bybit's recent BREV listing which tested similar structural patterns, and contradictory fund inflows despite prevailing fear sentiment.

According to the official Binance announcement, the exchange will list BREV for spot trading with multiple trading pairs including BREV/BTC and BREV/USDT. The Hodler Airdrop program will distribute tokens to qualifying BNB holders based on a snapshot mechanism, a common exchange strategy to boost platform engagement. Market analysts note this follows a pattern of exchange-driven token launches during periods of low volatility, where the lack of organic buying pressure creates ideal conditions for controlled price discovery.

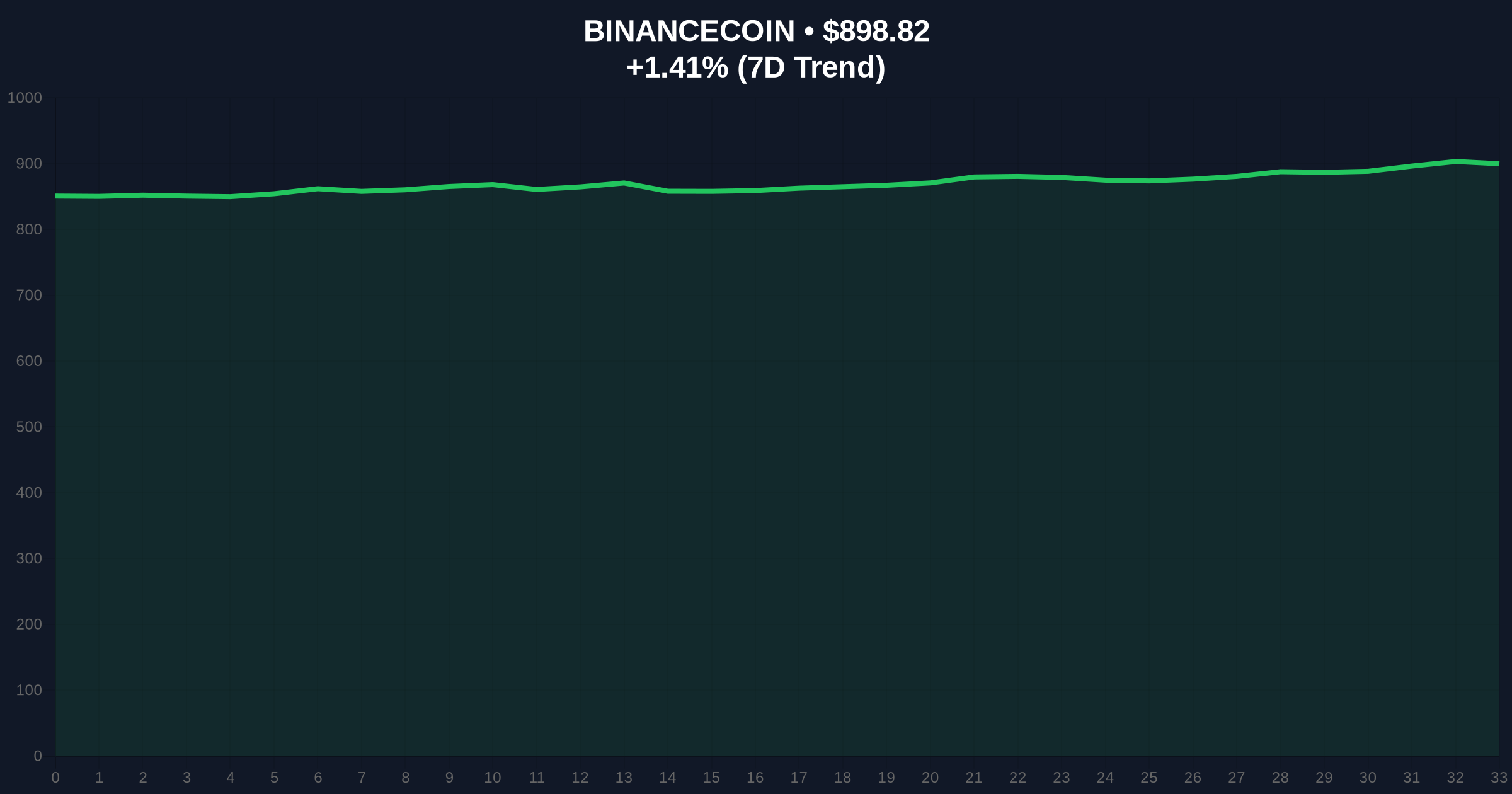

BNB's current price at $898.7 sits near a critical Fibonacci retracement level from its 2025 all-time high. The 24-hour trend of 1.40% represents minimal movement within a larger consolidation pattern. Volume profile analysis indicates thinning liquidity below $850, creating a potential Fair Value Gap that could be exploited post-listing. The Relative Strength Index (RSI) at 42 suggests neutral momentum with bearish divergence on higher timeframes. Market structure suggests the Bullish Invalidation level sits at BNB's $850 support, while the Bearish Invalidation level is the psychological resistance at $950. A break below $850 would invalidate the positive narrative and likely trigger stop-loss cascades.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Extreme fear contradicts positive listing news |

| BNB Current Price | $898.7 | Testing Fibonacci 0.618 retracement |

| BNB 24h Change | +1.40% | Minimal movement within consolidation |

| BNB Market Rank | #5 | Maintains top exchange token position |

| Global Sentiment | Fear | Contradicts exchange growth narrative |

For institutional players, this listing represents another test of market structure during fear periods. The SEC's ongoing scrutiny of exchange token listings, as documented in official SEC filings, adds regulatory risk to what appears as a routine announcement. Retail traders face asymmetric information disadvantages, particularly regarding the actual tokenomics and vesting schedules that won't be visible until post-listing on-chain analysis. The contradiction between extreme fear sentiment and positive exchange news creates cognitive dissonance that sophisticated traders may exploit through gamma squeeze strategies around listing dates.

Market analysts on X/Twitter express skepticism about the timing. One quantitative researcher noted, "Listing during fear periods allows exchanges to control price discovery with minimal organic volume." Another pointed to the structural similarity to previous airdrop events that resulted in immediate sell pressure from recipients. The dominant narrative questions whether this represents genuine platform growth or strategic positioning ahead of potential regulatory changes affecting exchange token economics.

Bullish Case: If BNB holds above the $850 invalidation level and BREV listing generates sustained volume above 50,000 ETH equivalent, we could see a relief rally toward BNB's $950 resistance. This scenario requires the Fear & Greed Index to improve above 40 and on-chain data to show net positive exchange flows post-listing.

Bearish Case: If BNB breaks below $850 support, the listing narrative collapses. This would likely trigger a liquidity grab down to the next major order block around $780, with BREV experiencing immediate post-listing sell pressure from airdrop recipients. The extreme fear sentiment would validate as the dominant market force, potentially dragging other exchange tokens into correlated declines.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.