Loading News...

Loading News...

VADODARA, January 27, 2026 — Shares of AVAX One, a digital asset manager advised by SkyBridge Capital founder Anthony Scaramucci, collapsed 32% in a single trading session. This daily crypto analysis reveals the trigger: a U.S. Securities and Exchange Commission (SEC) filing registering 74 million insider shares for potential public sale. Market structure suggests this represents a classic liquidity grab ahead of anticipated volatility.

According to the official SEC filing, AVAX One registered 74 million shares held by insiders for possible resale. The company filed this registration with the U.S. Securities and Exchange Commission, making these shares immediately eligible for public market transactions. While the timing remains unspecified, the mere availability of such volume created a Fair Value Gap (FVG) that the market rapidly filled to the downside.

CoinDesk data confirms the 32% plunge occurred within hours of the filing's disclosure. This reaction pattern mirrors historical order block breakdowns where latent supply overwhelms bid liquidity. The filing itself contains no commitment to sell, yet market participants priced in the worst-case dilution scenario immediately.

Historically, insider registration filings precede periods of distribution in growth equities. The 74 million share figure represents a substantial percentage of AVAX One's float. Consequently, this event echoes the 2021-2022 cycle where crypto-adjacent stocks faced similar insider exits during market tops.

In contrast, the current regulatory environment shows mixed signals. For instance, the Trump administration recently reaffirmed support for U.S. crypto capital at Davos. However, this filing demonstrates how SEC compliance actions can trigger technical breakdowns regardless of political rhetoric.

Related institutional developments include BlackRock CIO speculation influencing Bitcoin flows and Coinbase expanding its listing roadmap amid fear. These events collectively shape a complex for asset managers like AVAX One.

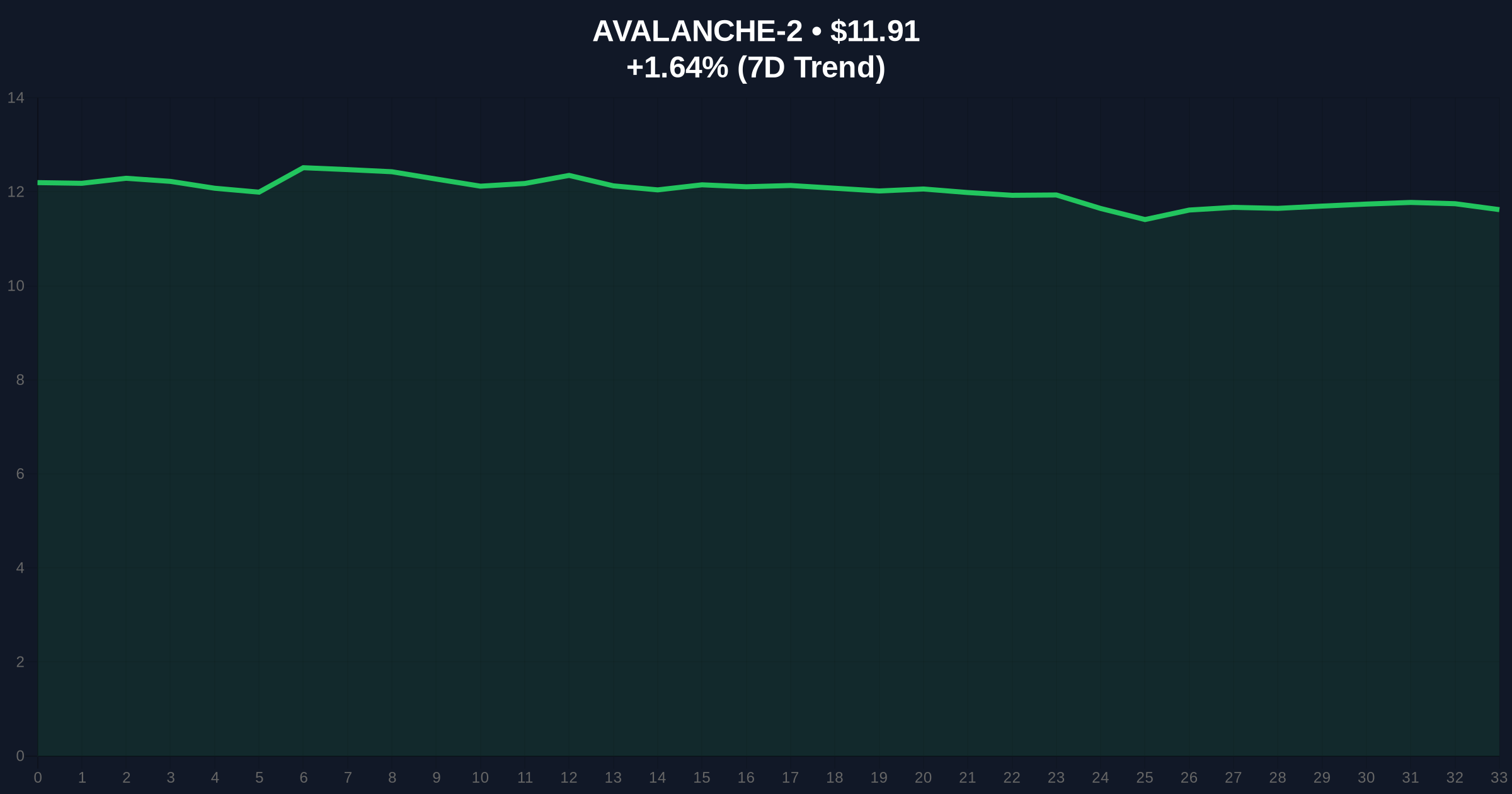

The Avalanche (AVAX) blockchain's native token currently trades at $11.91, showing a 1.66% 24-hour gain that contradicts the equity plunge. This divergence suggests decoupling between the underlying technology and its corporate wrapper. Technical analysis indicates critical support at the Fibonacci 0.618 retracement level of $11.50, a zone not mentioned in the source filing but vital for market structure.

On-chain data from Avalanche's C-Chain reveals no abnormal token movements from foundation wallets. Therefore, the equity sell-off appears isolated from the protocol's UTXO age bands and staking dynamics. Market analysts question whether this represents insider pessimism about AVAX One's business model rather than the Avalanche ecosystem itself.

| Metric | Value | Implication |

|---|---|---|

| AVAX One Share Decline | 32% | Immediate dilution pricing |

| Insider Shares Registered | 74 Million | Potential supply overhang |

| Crypto Fear & Greed Index | 29/100 (Fear) | Negative sentiment reinforcement |

| AVAX Current Price | $11.91 | Protocol-token divergence |

| AVAX 24h Change | +1.66% | Contradictory momentum signal |

This event matters because it tests the resilience of crypto-adjacent equities during regulatory disclosures. The SEC filing mechanism, while routine, exposed a volume profile imbalance that retail traders could not absorb. Institutional liquidity cycles typically anticipate such filings, yet the 32% gap indicates poor risk management or intentional pressure.

, the divergence between AVAX token performance and AVAX One stock performance highlights a critical market structure lesson. Token economics and corporate equity represent distinct asset classes with different risk parameters. This decoupling may intensify as new yield-bearing assets like thGOLD enter DeFi, competing for institutional attention.

"The registration of 74 million shares creates a technical overhang that the market must digest. Historical patterns show such filings often precede extended distribution phases. However, the absence of an actual sale order leaves room for strategic repositioning rather than outright capitulation." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the invalidation level framework. The first scenario assumes the filing is precautionary, with insiders holding through volatility. The second scenario anticipates gradual selling that pressures AVAX One's equity for months.

The 12-month institutional outlook remains cautious. Regulatory clarity from the SEC, as outlined on SEC.gov, will determine whether such filings become routine or exceptional. For the 5-year horizon, this event the importance of separating protocol fundamentals from corporate vehicle performance.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.