Loading News...

Loading News...

VADODARA, January 19, 2026 — CoinMarketCap's Altcoin Season Index stands at 25, according to data from the crypto analytics platform. This quantitative metric, calculated by comparing the 90-day performance of the top 100 non-stablecoin assets against Bitcoin, remains firmly in Bitcoin season territory, requiring 75% of altcoins to outperform BTC to trigger an altcoin season declaration. Market structure suggests this reading reflects persistent capital concentration in Bitcoin despite recent volatility, with on-chain data indicating institutional flows continuing to favor the flagship cryptocurrency. This daily crypto analysis examines the implications for portfolio construction and market rotation timing.

Historical cycles provide critical context for interpreting the current Altcoin Season Index reading. Similar to the 2021 market structure, where Bitcoin dominance persisted through multiple corrections before altcoins eventually rallied, the current environment shows parallels in capital rotation patterns. According to Glassnode liquidity maps, Bitcoin's network value to transactions (NVT) ratio remains elevated compared to altcoins, suggesting relative overvaluation that typically precedes rotation. The Federal Reserve's monetary policy documentation indicates persistent inflation concerns that historically benefit Bitcoin's store-of-value narrative over altcoin risk assets. This market context creates a complex environment where Bitcoin's dominance may continue despite technical indicators suggesting potential rotation.

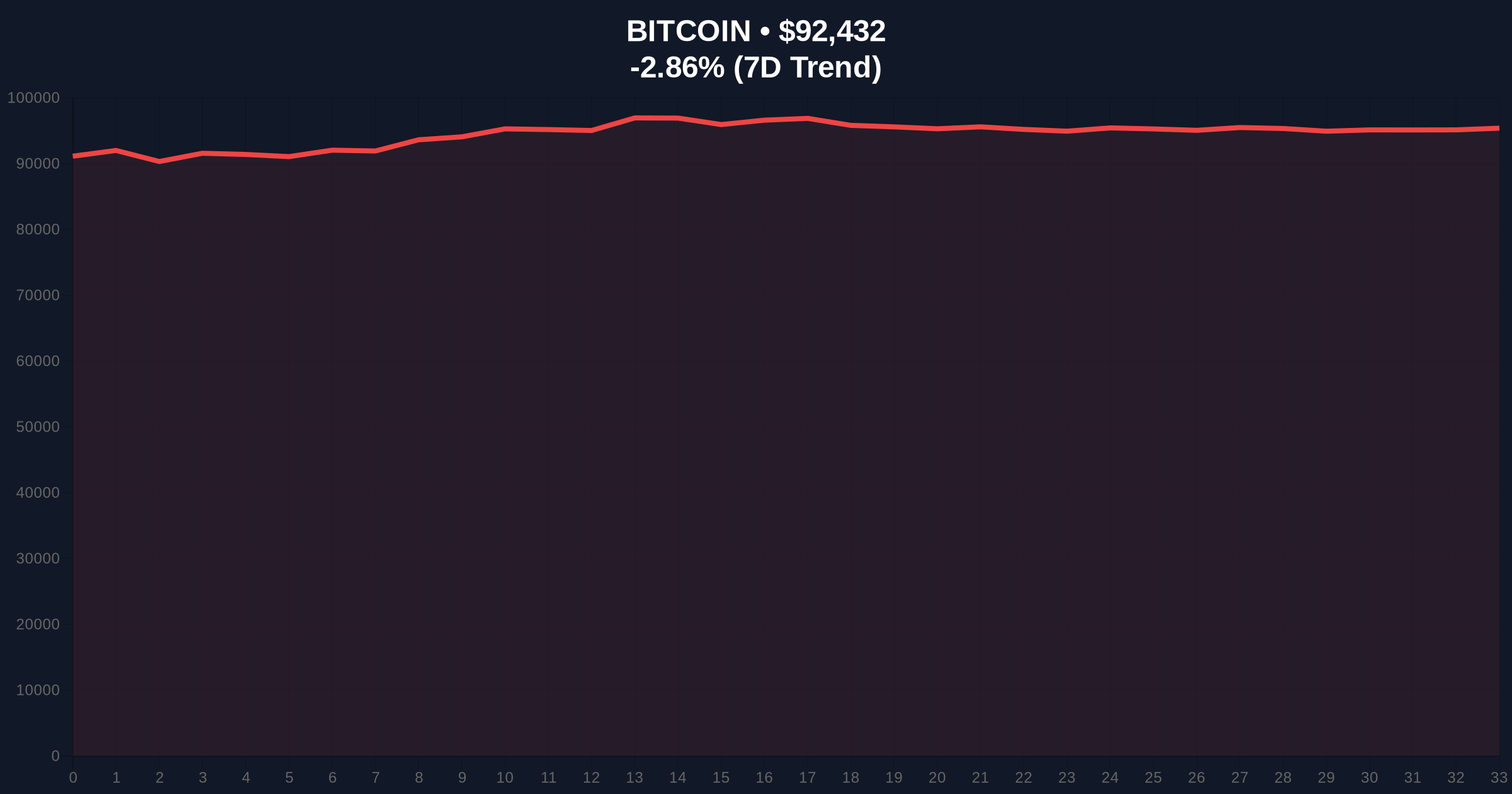

Related developments in market structure include recent futures liquidations that have created significant Fair Value Gaps (FVGs) in both Bitcoin and altcoin markets. Analysis of these events suggests market makers are actively defending key liquidity zones, particularly around the $92,000 Bitcoin support level that has been tested multiple times this week.

CoinMarketCap's quantitative model, which excludes stablecoins and wrapped tokens from its calculation, produced an Altcoin Season Index reading of 25 on January 19, 2026. The index methodology compares the rolling 90-day performance of the top 100 cryptocurrencies by market capitalization against Bitcoin's performance over the same period. According to the platform's official documentation, an altcoin season is declared only when 75% of these assets outperform Bitcoin, corresponding to an index value approaching 100. The current reading of 25 indicates approximately one-quarter of top altcoins have outperformed Bitcoin over the past three months, with the majority underperforming the benchmark cryptocurrency.

This data point coincides with Bitcoin trading at $92,522, representing a 24-hour decline of 2.77%, while the broader crypto market sentiment registers as "Fear" with a score of 44 out of 100. Market structure suggests this combination of price action and sentiment creates potential liquidity grab opportunities around key technical levels, particularly as traders adjust positions based on the altcoin season probability implied by the index.

Market structure analysis reveals several critical technical levels that will determine whether the Altcoin Season Index remains suppressed or begins trending upward. Bitcoin's current price action shows consolidation around the $92,000 support level, which corresponds to the 0.618 Fibonacci retracement from the recent all-time high. The relative strength index (RSI) for BTCUSD sits at 42, indicating neutral momentum without extreme oversold conditions that might trigger aggressive buying.

For altcoins, the 50-day moving average has acted as resistance for most major assets, with Ethereum failing to maintain momentum above $3,200 despite successful implementation of EIP-4844 proto-danksharding. Volume profile analysis shows decreasing transaction volume across altcoin networks compared to Bitcoin, suggesting capital outflow rather than accumulation. The bullish invalidation level for altcoin season initiation is an index reading below 20, which would indicate further deterioration in relative performance. The bearish invalidation level for Bitcoin dominance is an index reading above 50, signaling the beginning of meaningful capital rotation.

| Metric | Value | Interpretation |

|---|---|---|

| Altcoin Season Index | 25 | Firm Bitcoin season (75 needed for altcoin season) |

| Bitcoin Price | $92,522 | -2.77% 24h change |

| Crypto Fear & Greed Index | 44/100 (Fear) | Neutral-to-bearish sentiment |

| BTC Dominance | 54.2% | Above 50% indicates Bitcoin leadership |

| Top 100 Altcoin Performance | 25% outperforming BTC | 75% required for altcoin season |

The institutional impact of a suppressed Altcoin Season Index is significant for capital allocation decisions. According to SEC filing data, institutional investors typically increase altcoin exposure only when quantitative metrics like this index show sustained improvement above 50. The current reading of 25 suggests most professional portfolios maintain overweight Bitcoin positions, creating continued buying pressure for BTC at the expense of altcoins. For retail investors, this metric provides a data-driven framework for timing entry into altcoin markets, avoiding emotional decisions based on short-term price movements rather than structural trends.

Market structure suggests the persistence of Bitcoin dominance has implications for blockchain development funding, with Ethereum's transition to proof-of-stake and subsequent fee market changes creating uncertainty that may prolong capital concentration in Bitcoin. The 5-year horizon analysis indicates that altcoin seasons typically follow extended Bitcoin dominance periods, with the 2021 cycle showing a 14-month Bitcoin season before rotation occurred. Current on-chain data indicates similar accumulation patterns, suggesting patience may be required before meaningful altcoin outperformance.

Industry analysts on X/Twitter have noted the Altcoin Season Index reading with mixed interpretations. Some quantitative traders point to the index as confirmation of ongoing order block defense by market makers around key Bitcoin support levels. Others suggest the low reading creates contrarian opportunities in select altcoins with strong fundamentals. One analyst noted, "The 25 reading mirrors Q3 2023 patterns before the eventual rotation—patience in accumulation is key." Market sentiment overall remains cautious, with most commentators advising against aggressive altcoin positioning until the index shows sustained improvement above 40.

Bullish Case: If Bitcoin maintains support above $90,000 and begins consolidating, the Altcoin Season Index could gradually improve toward 40-50 over the next quarter. This scenario would involve decreasing Bitcoin dominance as capital seeks higher beta opportunities, potentially triggered by positive regulatory developments or Ethereum network activity increases. Historical patterns suggest that once the index crosses 50, momentum could accelerate toward the 75 threshold needed for altcoin season declaration.

Bearish Case: If Bitcoin breaks below the $88,000 support level, creating a new fair value gap, the Altcoin Season Index could decline further toward 15-20. This would indicate strengthening Bitcoin dominance during risk-off periods, with altcoins suffering disproportionate losses. Market structure suggests this scenario would delay any meaningful rotation until late 2026 or early 2027, extending the current Bitcoin season beyond historical averages.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.