Loading News...

Loading News...

VADODARA, February 9, 2026 — The Altcoin Season Index from crypto data platform CoinMarketCap stands at 24. This daily crypto analysis reveals persistent Bitcoin dominance. Market structure suggests capital rotation away from altcoins. Extreme fear grips global sentiment.

According to CoinMarketCap's official methodology, the index currently reads 24. It compares price performance of the top 100 coins by market capitalization against Bitcoin. Stablecoins and wrapped tokens are excluded. An altcoin season requires 75% of these coins outperforming Bitcoin over 90 days. The opposite defines a Bitcoin season. A score closer to 100 indicates altcoin dominance. The current 24 score confirms Bitcoin's outperformance.

Market analysts attribute this to institutional preference for Bitcoin's liquidity. On-chain data indicates reduced altcoin trading volume. Consequently, capital flows concentrate in Bitcoin. This creates a liquidity grab scenario. Altcoins face selling pressure.

Historically, altcoin seasons follow Bitcoin bull runs. The 2021 cycle saw the index hit 92. In contrast, 2024's post-halving period maintained Bitcoin dominance. The current 24 score mirrors late 2023 patterns. Underlying this trend is macroeconomic uncertainty.

, extreme fear sentiment exacerbates the divergence. The Crypto Fear & Greed Index sits at 14. This indicates panic selling. Retail investors flee altcoins for safety. Institutional players accumulate Bitcoin at perceived discounts.

Related developments include the Crypto Fear & Greed Index hitting 14, community rejection of bearish predictions, and workforce cuts signaling market contraction.

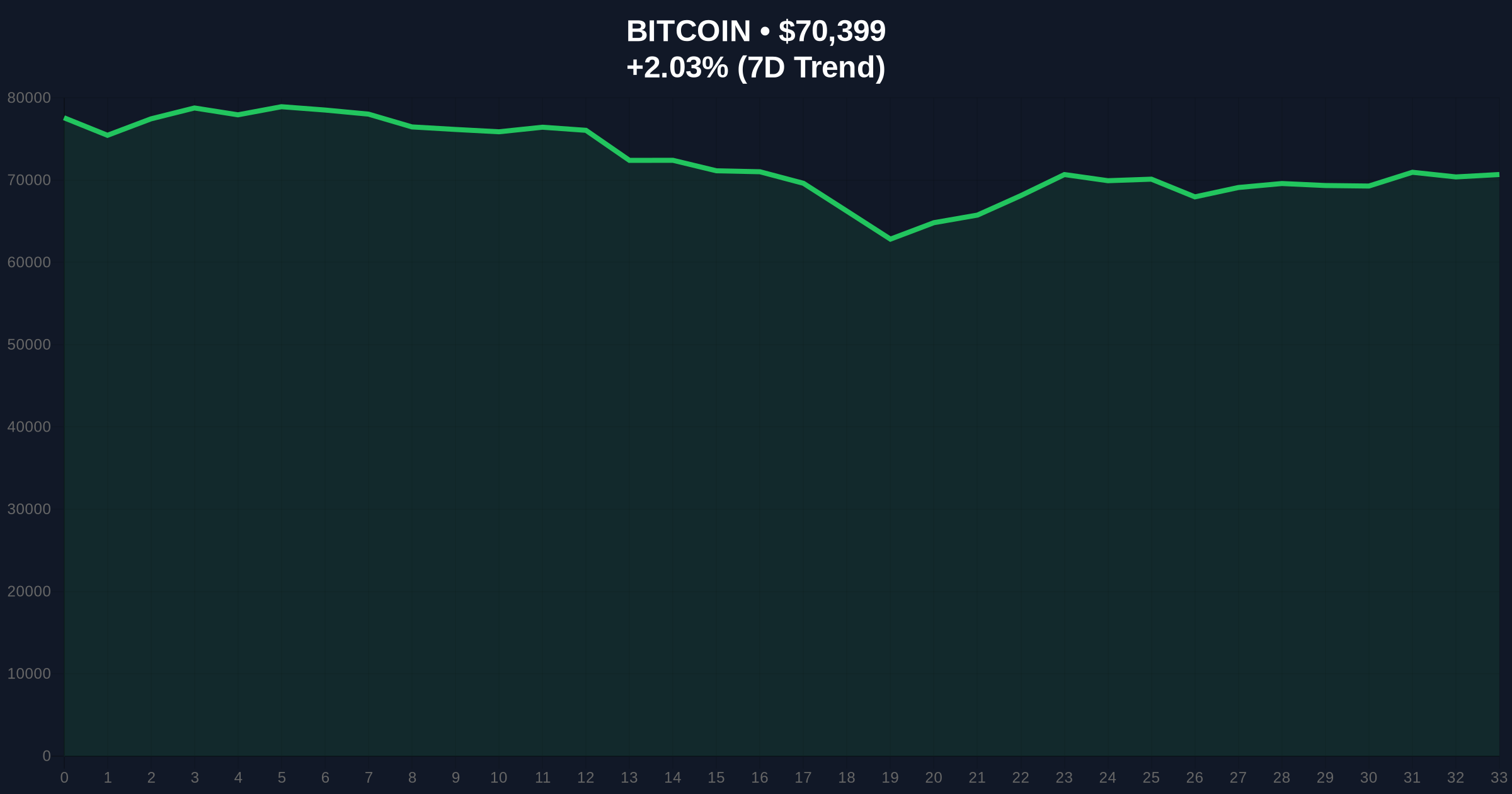

Bitcoin currently trades at $70,408. This represents a 2.04% 24-hour gain. Technical analysis reveals a critical Fair Value Gap (FVG) between $69,800 and $71,200. Market structure suggests this gap acts as resistance.

Support levels cluster around the Fibonacci 0.618 retracement at $68,200. This level aligns with a high-volume node on the Volume Profile. A break below invalidates the current consolidation. RSI readings hover at 45, indicating neutral momentum.

Altcoins show weaker technicals. Ethereum tests its 200-day moving average at $3,450. Many altcoins breach their order blocks. This confirms the index's bearish signal for altcoins.

| Metric | Value | Implication |

|---|---|---|

| Altcoin Season Index | 24 | Strong Bitcoin Dominance |

| Crypto Fear & Greed Index | 14 (Extreme Fear) | Panic Selling Environment |

| Bitcoin Price | $70,408 | +2.04% (24h) |

| Index Threshold for Altcoin Season | 75 | Current Score Far Below |

| Top Coins Analyzed | 100 (excl. stablecoins) | Broad Market Representation |

This index matters for portfolio allocation. Institutional liquidity cycles favor Bitcoin during fear periods. Retail market structure weakens for altcoins. Historical cycles suggest prolonged Bitcoin dominance can last 6-12 months.

Real-world evidence includes reduced altcoin funding rates. Perpetual swap markets show negative funding for many altcoins. This indicates short positioning. Spot volumes for altcoins decline relative to Bitcoin.

The 5-year horizon sees Bitcoin cementing its store-of-value narrative. Altcoins may struggle until macroeconomic conditions improve. Regulatory clarity, as outlined on SEC.gov, could shift this dynamic.

"The Altcoin Season Index at 24 confirms capital preservation strategies. Investors rotate into Bitcoin during uncertainty. This isn't about altcoin failure. It's about Bitcoin's resilience as a market anchor." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge. Market structure suggests a consolidation phase.

The 12-month institutional outlook remains cautious. Bitcoin dominance may persist through Q2 2026. Altcoins need a catalyst like Ethereum's Pectra upgrade to regain momentum. Macro factors like interest rate decisions will dictate the pace.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.