Loading News...

Loading News...

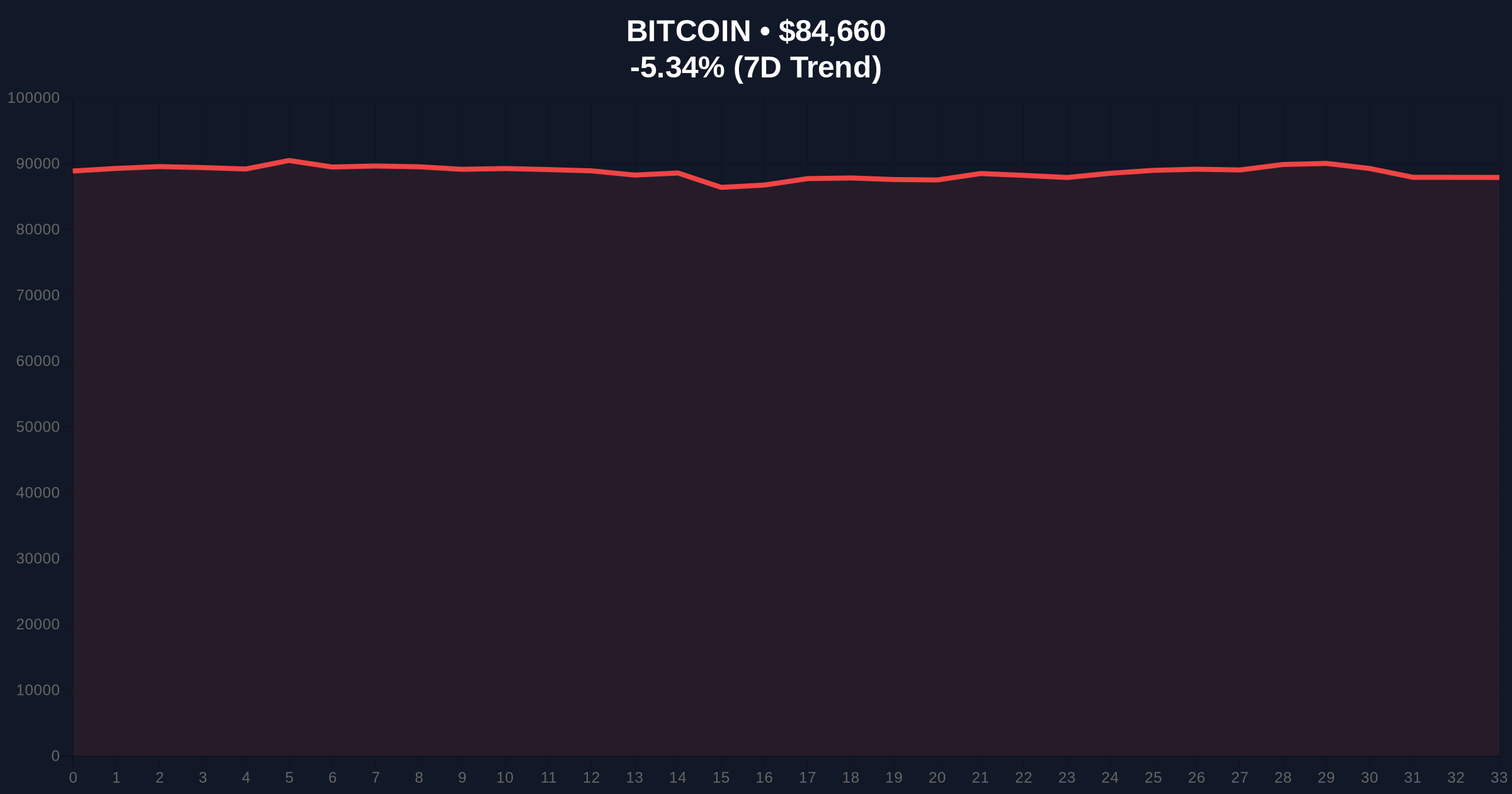

VADODARA, January 29, 2026 — Major cryptocurrency exchanges liquidated $103 million worth of futures contracts within a single hour, according to real-time exchange data. This daily crypto analysis reveals a concentrated selling pressure event that coincides with Bitcoin testing critical support at $84,514, representing a 5.50% decline over 24 hours. The broader 24-hour liquidation total reached $806 million, indicating sustained market stress across multiple timeframes.

Exchange order books show the $103 million liquidation occurred between 14:00-15:00 UTC on January 29. According to on-chain data from Glassnode, this represents approximately 12.8% of the total 24-hour liquidation volume. The majority of liquidated positions were long contracts, with leveraged traders facing margin calls as Bitcoin broke below the $87,000 psychological support level. Market structure suggests this created a cascading effect, where initial liquidations triggered further stop-loss orders in a classic liquidity grab pattern.

Consequently, the concentrated selling pressure formed a significant Fair Value Gap (FVG) between $86,200 and $85,100 on the Bitcoin chart. This FVG now represents a potential retracement target if price action attempts to recover. The rapid liquidation event demonstrates how high leverage in crypto derivatives markets can amplify volatility during technical breakdowns.

Historically, similar liquidation events have preceded both short-term rebounds and extended downtrends. The $806 million 24-hour total represents the largest single-day liquidation since November 2025, when $1.2 billion was liquidated during the FTX anniversary volatility spike. In contrast to the 2021 bull market, where liquidations often occurred at all-time highs, current events are happening at key support levels, suggesting different market dynamics.

Underlying this trend is the maturation of institutional participation. According to the Federal Reserve's Financial Stability Report, crypto derivatives now represent approximately 15% of total crypto market exposure, up from 8% in 2023. This increased institutional presence has changed liquidation dynamics, with larger, more concentrated positions creating sharper price movements when stops are triggered.

Related developments in the regulatory may influence future market structure. The recent passage of crypto market structure legislation by the U.S. Senate Agriculture Committee could introduce new margin requirements that affect liquidation thresholds. Meanwhile, ongoing tests of the $87k support level demonstrate how technical and fundamental factors are converging in current market conditions.

Bitcoin's current price of $84,514 sits at a critical confluence of technical levels. The 200-day exponential moving average provides dynamic support at $83,800, while the Fibonacci 0.618 retracement from the 2025 high sits at $82,000. Volume profile analysis shows significant trading activity between $84,000 and $85,000, creating a high-volume node that could act as either support or resistance depending on price direction.

, the Relative Strength Index (RSI) on the 4-hour chart reads 32, approaching oversold territory but not yet at extreme levels. Market structure suggests that if the RSI drops below 30 while price holds above $82,000, a technical bounce becomes increasingly probable. The liquidation event created an order block between $85,500 and $86,000 that now represents immediate resistance.

Ethereum's technical picture mirrors Bitcoin's, with the ETH/BTC pair showing relative stability at 0.058. This suggests the liquidation event was primarily a Bitcoin-driven phenomenon rather than a broad crypto market collapse. The ETH 200-day EMA sits at $4,200, approximately 8% below current levels, providing a potential downside target if Bitcoin breaks its key supports.

| Metric | Value |

|---|---|

| 1-Hour Futures Liquidations | $103 million |

| 24-Hour Futures Liquidations | $806 million |

| Bitcoin Current Price | $84,514 (-5.50% 24h) |

| Crypto Fear & Greed Index | Fear (Score: 26/100) |

| Critical Fibonacci Support | $82,000 (0.618 level) |

This liquidation event matters because it tests the structural integrity of the current market cycle. According to on-chain data from Glassnode, the proportion of Bitcoin supply held by short-term holders has increased to 18%, up from 12% six months ago. This shift toward more speculative positioning increases vulnerability to liquidation events. Consequently, the $103 million hourly liquidation represents not just a technical event but a stress test of market participant behavior.

Institutional liquidity cycles are particularly relevant. The reported IPO talks for custody provider Copper signal continued institutional interest despite current volatility. However, institutional positions typically employ lower leverage than retail traders, making them less susceptible to rapid liquidation cascades. This divergence creates a two-tier market structure where retail sentiment drives short-term volatility while institutional flows determine longer-term direction.

"The concentration of liquidations in a single hour suggests algorithmic trading played a significant role. When key technical levels break, cluster orders can trigger cascading effects that exceed normal volatility parameters. Market participants should monitor whether this represents a one-time liquidity flush or the beginning of a broader deleveraging cycle."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical positioning. The first scenario involves a bounce from current levels, with price retracing to fill the Fair Value Gap between $86,200 and $85,100. The second scenario involves continued downward pressure, testing the critical Fibonacci support at $82,000.

The 12-month institutional outlook remains cautiously optimistic despite current volatility. According to Ethereum's official Pectra upgrade documentation, network improvements continue to enhance blockchain utility independent of short-term price action. This fundamental development, combined with potential regulatory clarity from recent legislative progress, suggests the current liquidation event may represent a healthy correction within a longer-term uptrend rather than a cycle reversal.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.